Monday Tuesday Wednesday Thursday Friday

This location does not accept deposits. Consultations are by appointment only.

Explore our services

We serve personal and institutional clients who want to change, improve, and optimize how they invest and save.

Eligibility

Tax Benefits

Who contributes

Contribution amounts

Contributions amounts are determined by the IRS. See Retirement Topics – 401(k) and Profit-Sharing Plan Contribution Limits for current information.

Withdrawals

Fees

Contributions limits for

Employers may contribute up to 25% of compensation, up to a maximum of $61,000 in

Employees may contribute up to $22,500 for ($27,000 if 50 or older)

The total employer and employee contributions cannot exceed $61,000 in

Investment Options

A wide range of mutual funds, stocks, bonds, ETFs, and more.

Streamline the process of consolidating assets, buying and selling securities, and managing cash flow to cover expenses and pay taxes.

Begin by learning how easy it is to open an account.

Trust Account

With a Trust Account, you can plan ahead and simplify the management and protection of your assets.

Estate Account

An Estate Account helps you manage and distribute an estate’s assets, consolidate assets, and access cash to pay taxes or cover expenses.

Charitable Account

Setting up a Charitable Account helps you structure your giving, manage taxes, and simplify recordkeeping.

- Hedge Funds

- Private Equity

- Natural Resources

- Real Estate

- Infrastructure

- Collectibles

- Numismatics

Precious Metals/Bullion

For clients navigating the complexities of investment and wealth management, annuities offer a strategic complement to their retirement planning portfolio. As contractual agreements with insurance companies, annuities guarantee a stream of income for life, a cornerstone of financial stability in retirement. These financial instruments are designed to supplement, rather than supplant, other retirement savings vehicles, providing a multifaceted approach to retirement security.

Key advantages of annuities include tax-deferred growth, allowing investments to compound over time without immediate tax implications, thereby enhancing the accumulation phase of retirement planning. Guaranteed yield options offer a fixed return, mitigating the risk of market volatility, while downside protection shields against market downturns, ensuring the principal investment remains secure. Furthermore, annuities offer flexible withdrawal options, catering to varying financial needs in retirement, alongside providing potential protection for beneficiaries through death benefits.

The annuity landscape is diverse, featuring variable annuities, which offer investment options with varying risk and growth potential; fixed annuities, providing a stable, guaranteed return; indexed annuities, linking growth potential to a market index while offering downside protection; and immediate or deferred income annuities, designed to begin payouts either immediately or at a future date. Each type caters to different investment profiles and objectives, underscoring the importance of aligning annuity selection with individual financial goals and risk tolerance as part of a comprehensive wealth management strategy.

Mauris finibus eros eu orci iaculis laoreet. In accumsan nulla ut sagittis tristique. Morbi a sollicitudin dui, quis tincidunt purus. Pellentesque eu lacinia lacus. Vestibulum tincidunt erat ac massa gravida accumsan. Suspendisse finibus commodo arcu, sed dapibus enim tincidunt in. Suspendisse pretium mollis ex, ut auctor neque pellentesque a. Morbi vel cursus odio, at interdum lorem. Pellentesque vitae eros sapien.

Nullam feugiat eleifend felis eu aliquam. Etiam bibendum, ante nec efficitur lacinia, lectus eros laoreet lectus, sit amet ultricies magna mi vel felis. Quisque ut varius arcu. Praesent efficitur, nisi at imperdiet luctus, tellus dui dignissim purus, et aliquam diam metus ac velit. Mauris aliquet rutrum mauris, ac tempus arcu eleifend sit amet. Integer at lacinia turpis. Morbi vehicula justo at velit facilisis, ac dictum quam sodales. In hac habitasse platea dictumst.

Nunc finibus, magna sed laoreet malesuada, risus libero iaculis tellus, ac consequat enim nunc sed metus. Cras a condimentum elit, vel convallis tellus. Sed mauris mi, sollicitudin eu tellus ut, efficitur scelerisque justo. Fusce id nibh ut sapien egestas consectetur sed nec arcu. Aliquam et orci nec nulla pellentesque varius. Sed mi mauris, ultricies eu pharetra eget, tincidunt eu enim. Pellentesque convallis dolor nisl.

Have a general question about investing? Learn more about what’s available to you at Global Advisers

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

- High-Yield Checking and Savings

- Bank and Brokerage CDs

- Visa© or MasterCard© debit card

- Home Lending

Our family office services extend beyond traditional wealth management to encompass advanced cash management and strategic borrowing solutions, designed to streamline your day-to-day financial transactions and enhance liquidity access. Recognizing the importance of flexibility in managing personal and business finances, we offer tailored lending and banking solutions that cater to both spheres. Whether it’s optimizing cash flow, financing a new venture, or managing operational expenses, our approach ensures that your liquidity needs are met with precision and foresight. This comprehensive financial orchestration enables us to support the seamless execution of your transactions, ensuring that your financial resources are aligned with both your immediate needs and long-term objectives, thereby facilitating a holistic approach to your wealth strategy.

We provide two distinct categories for Certificates of Deposit: bank CDs and brokerage CDs, each catering to varying investor preferences and risk appetites.

Bank CDs represent a traditional and secure investment avenue. As federally insured deposits, they guarantee a predetermined interest rate over a fixed term, with the principal amount assured upon maturity. This federal insurance, provided by agencies like the FDIC, shields investors from the risk of bank failure, making bank CDs a low-risk option for preserving capital while earning steady, albeit potentially modest, returns.

Conversely, brokerage CDs, although similar in structure—offering a set interest rate for a defined period—diverge significantly in terms of risk and potential yield. Not covered by FDIC insurance, these CDs expose investors to the credit risk of the issuing bank. In exchange for bearing this additional risk, investors are typically rewarded with higher yields compared to traditional bank CDs. This makes brokerage CDs an appealing option for those willing to navigate the complexities of credit assessment to enhance their investment income.

Both types of CDs serve as strategic components within a broader wealth management portfolio, offering a spectrum of risk and return profiles to accommodate diverse financial goals and risk tolerances among sophisticated investors.

We can help answer questions about inheriting an account, gifting securities, or other Global Advisers account ownership changes

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Integrating your investment account with your bank account is a prudent strategy for investment and wealth management clients, facilitating seamless financial management. This linkage enables the swift and secure online transfer of funds between accounts via a protected platform, enhancing the efficiency of managing your investments and liquidity.

Our checking account options are designed with the investor in mind, offering the convenience of no maintenance fees and eliminating the requirement for a minimum balance, thus providing flexibility and simplicity. Additionally, our savings accounts come with the assurance of FDIC insurance up to $250,000, safeguarding your deposits against bank failure and offering peace of mind regarding the security of your assets.

Consultation with your advisor is crucial to explore the options available among our custodians for linked accounts. This ensures that you select a banking solution that aligns with your financial goals, investment strategy, and the need for easy access to funds, all while maximizing the benefits of integrated financial management. This approach underscores a holistic strategy towards wealth management, marrying investment growth with prudent cash management.

A good college plan is a road map that can guide you through school to college, advise you and what to do, and track your progress throughout the process. It begins by creating a plan that defines your educational needs.

Are you planning to help your children, grandchildren, or another child close to you with their education expenses? Or thinking of taking classes yourself? There are many options to help you achieve this goal. We suggest taking some time to think critically about the future costs, which include more than the cost of tuition.

Get contact information for 529 and UGMA/Custodial plans at Global Advisers

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Eligibility

Tax Benefits

Who contributes

Contribution amounts

Withdrawals

Fees

Monthly service fees: $0

$0 account open or maintenance fees

Commissions: $0 per online listed equity trades

Other account fees, fund expenses, and brokerage commissions may apply

Advisory fees:

Global Advisers charges an annual management fee.

Contributions limits for

Determined by your existing plan.

Investment Options

Full range of investment options.

Emergencies are a fact of life. Planning for them can dramatically reduce the stress associated with job loss or catastrophe.

Where we add value:

- Customized Emergency Fund Strategy: Delivering expert, ongoing guidance from the outset, tailored to the creation and optimization of your emergency fund.

- Prudent Saving and Strategic Allocation: Emphasizing the importance of careful saving and strategic allocation to build a robust emergency fund.

- Comprehensive Fund Management:

- Planning and establishing a solid emergency fund tailored to your financial situation.

- Conducting periodic evaluations and making adjustments to ensure the fund remains effective.

- Leveraging comprehensive research on saving strategies and economic trends to inform decisions.

- Financial Security and Peace of Mind: Dedicated to providing you with a strong financial foundation, ensuring your emergency fund serves as a reliable safeguard against unexpected financial difficulties.

Related

For investment and wealth management clients, the significance of disability insurance cannot be overstated, particularly as a preemptive measure to safeguard one’s income stream against the unpredictable eventuality of a disability or injury rendering them unable to work. While it’s true that certain employers offer disability insurance as part of their benefits package, it’s crucial to recognize that these employer-provided policies frequently offer coverage that falls short of fully covering an individual’s regular living expenses during periods of incapacity.

This gap in coverage underscores the need for a comprehensive disability insurance policy tailored to an individual’s specific income replacement needs. Such a policy ensures that, in the event of a disability, the insured can maintain their standard of living without having to deplete savings or investment accounts. Assessing one’s financial obligations and lifestyle costs is essential in determining the appropriate level of coverage needed to secure a financial safety net that aligns with existing wealth management strategies. This strategic integration of disability insurance into one’s broader financial plan is a prudent approach to mitigating the financial risks associated with long-term absence from work due to health issues, ensuring continuity in meeting both current living expenses and future financial goals.

Galleon Core accounts are for investors who seek a low-fee option to invest in the stock, bond, and commodity markets, and do not seek additional services such as financial or estate planning, wealth management services, managed philanthropy, or retirement planning. Investors in need of these types of services should contact us to talk about our comprehensive wealth management and financial planning services.

Core accounts are managed differently than full-service, actively managed accounts in that Core accounts are rebalanced annually; do not qualify for margin trading; and do not include hedge funds, US Spot Gold, futures, options on futures, derivatives (except covered call writing), and metals.

Core accounts are available for IRAs, individual accounts, business accounts, and trust accounts.

Giving to charity is rewarding. Managing your donations is another matter.

Where we add value:

- Personalized Philanthropic Guidance: Our Managed Philanthropy Services offers specialized, ongoing advice for impactful charity donations, tailored to your values and financial situation.

- Strategic Charitable Giving Planning: Emphasizing the importance of strategic planning for enhanced effectiveness and fulfillment in philanthropy.

- Philanthropic Process Assistance:

- Identifying causes and charities that resonate with your personal values.

- Structuring donations for maximum tax benefits and financial efficiency.

- Legacy and Financial Goals Alignment:

- Providing insights on creating a lasting philanthropic legacy through trusts or endowments.

- Ensuring your charitable efforts are integrated with your overall financial strategy.

- Empowered and Structured Giving: Committing to a charitable giving plan that not only contributes positively to the world but also aligns with your comprehensive financial goals.

Related

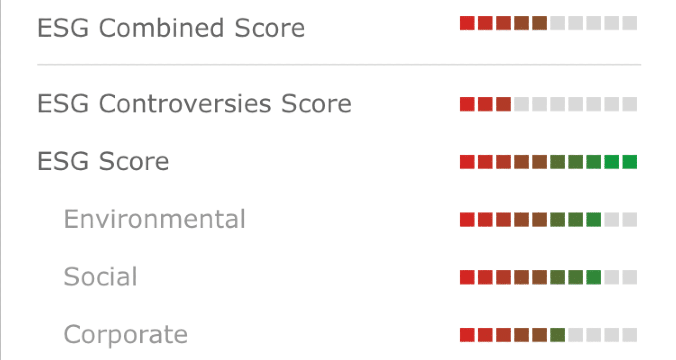

The ESG report delivers a comprehensive overview, including an ESG ratings summary, an analysis of controversy distribution, and details on the portfolio’s largest holdings. The summary details encompass the ESG score, Controversies Score, Combined Score, the share of portfolio companies with an ESG score, and a breakdown by ESG pillars. A bar chart depicting controversy distribution showcases the controversies score relative to the position weight (%) within the portfolio. Additionally, the report highlights the top 10 holdings, along with their respective ESG scores, and identifies the highest and lowest ESG performers.

A trust provides legal protection for your assets and ensures those assets are distributed according to your wishes.

Where we add value:

- Tailored Trust Establishment Guidance: Offering specialized, ongoing advice for creating and funding a trust, customized to your specific needs.

- Strategic Long-Term Investment Approach: Focused on strategic, long-term investing as the foundation for accumulating the necessary assets for your trust.

- Comprehensive Trust Funding Strategy:

- Developing a personalized investment strategy to grow trust funds.

- Conducting regular strategy reviews to ensure alignment with your trust goals.

- Engaging in in-depth research to stay responsive to changing financial and legal landscapes.

- Legacy Preservation and Financial Security: Dedicated to crafting a comprehensive plan that secures your financial legacy and aligns with your future vision.

Related

Manage and distribute estate assets

Availability

For executors or court-appointed administrators of estates

Benefits and features

Full brokerage account options make it easy to facilitate the distribution of an estate’s financial assets

Easy manage, consolidate, buy and sell, or access cash to pay taxes

Get accurate estate value for IRS purposes

Transfer titles to heirs

We provide full advisory and investment management of assets

Service and support 24/7

Requirements

To open an Estate Account you will need to provide the following:

- The decedent’s full name

- The Tax ID number of the estate

- Statement information for funds you may want to transfer

- The decedent’s account number, if transferring from an existing internal account

- Contact information

- Social Security number

- Employer’s name and address (if applicable)

Additionally, you’ll need to submit a copy of your letters testamentary (or letters of administration), certified as currently valid by the court clerk within the past 60 days and bearing the clerk’s original signature and seal.

Within our family office services, a team of dedicated professionals stands ready to assist in navigating the complex and often sensitive dynamics of family governance. Recognizing the unique challenges that wealth can introduce to family relationships, our experts are adept at addressing sensitive issues, enhancing communication, and managing conflicts. We act in concert with your external advisors to foster a unified approach towards achieving your family’s collective goals. This collaborative strategy ensures that all family members move forward with a shared vision, aligning individual aspirations with the family’s overarching objectives. Our role is pivotal in facilitating a cohesive and harmonious environment that supports both the prosperity and well-being of your family.

Family Office Services

Helping you navigate the complex, multigenerational challenges of managing significant wealth. Explore Family Office Advisory Services Planning

Our integrated approach to planning, which includes family issues, wealth transfer, asset protection, and business succession planning helps you maintain family unity across generations by focusing on family mission, governance, conflict management, and family endowments.

Financial Planning takes into consideration all aspects of your wealth and income when preparing your plan. Whether you’re in the process of building your wealth, or if you’re near to or already in retirement, all of our plans begin with a conversation. Our goal is to understand your specific needs and make your plan more manageable. When you engage with us, we prepare a financial plan that focuses on retirement, college, estate, divorce, and business planning.

1:1

Advisor-to-client ratio

We support the resources needed to help highly affluent families manage the complex, multigenerational challenges of managing significant wealth.

Initial Review

Conduct preliminary due diligence (review of balance sheet and existing estate strategy)

Discovery

Explore goals, concerns and aspirations with respect to tax planning, legacy, wealth transfer, asset protection, trust planning and philanthropy

Analysis

Analyze available planning techniques in relation to your financial goals

Collaboration

Collaborate with your tax and legal advisors and other specialists

Account fees and minimums

We offer a comprehensive range of investment options to meet a wide variety of goals.

Trust accounts

Custodial Fees:

Monthly service fees: $0

Account opening minimum: $0

Commissions: $0 online listed stock and ETF commissions

Management Fees:

Based on total household assets.

Estate accounts

Custodial Fees:

Monthly service fees: $0

Account opening minimum: $0

Commissions: $0 online listed stock and ETF commissions

Management Fees:

Based on total household assets.

Charitable accounts

Fees vary for Charitable Accounts.

View the complete fee schedule

Investors have a lot to think about. Life insurance should be one of them.

Where we add value:

- Personalized Financial Planning for Life Insurance: Providing custom, ongoing investment advice to financially prepare for life insurance coverage.

- Long-Term Financial Strategy for Insurance Premiums: Utilizing strategic, long-term financial planning to ensure affordability and alignment of life insurance policies with your goals.

- Tailored Savings and Investment Plan:

- Assessing financial situations to create a savings plan for insurance premiums.

- Evaluating various life insurance policies to make informed, strategic choices.

- Regular Strategy Reviews and Market Research:

- Conducting regular portfolio reviews and adjustments based on life changes and financial goals.

- Continuous research into market trends and insurance products to optimize your financial strategy.

- Secured Financial Foundation for Peace of Mind: Ensuring your investment in life insurance is financially sound and aligned with your long-term objectives, providing security and peace of mind.

Related

Sometimes other people in your life need some help.

Where we add value:

- Tailored Financial Support Advice: Delivering personalized, ongoing guidance for effectively supporting a loved one or parent financially.

- Strategic Long-Term Planning: Focusing on long-term financial planning to ensure impactful and sustainable assistance.

- Structured Financial Support Planning:

- Assessing effective methods of financial assistance.

- Considering tax implications to optimize support.

- Ensuring alignment with your overall financial goals.

- Guidance on Financial Boundaries: Offering advice on maintaining financial stability for both you and your loved one.

- Empowering Assistance Strategy: Committing to a strategy that makes your financial support a positive influence in your loved one’s life, safeguarding your financial future.

Related

For investment and wealth management clients exploring real estate financing options, selecting the appropriate mortgage solution is paramount. Whether you’re in the market to purchase a new home, looking to refinance an existing mortgage, or considering tapping into your home’s equity, the right mortgage product can significantly impact your financial strategy.

Home lending solutions tailored to the sophisticated needs of investors offer a comprehensive service model, combining convenience with the expertise of leading mortgage banks. These solutions are designed to align with your broader financial goals, offering competitive rates, flexible terms, and a variety of products to meet diverse needs—from fixed-rate mortgages for predictable repayment schedules to adjustable-rate mortgages that provide initial lower payments.

Working with a mortgage provider that understands the intricacies of wealth management ensures you receive advice and options that not only meet your immediate financing needs but also integrate seamlessly with your overall investment portfolio. This holistic approach ensures that your real estate investments complement your long-term financial objectives, providing both stability and growth potential within your wealth management strategy.

The best way to compare Core accounts to mutual funds or ETFs is to think of Core as a selection of low-fee, tax-efficient, diversified sub-accounts that, when grouped together, have the potential to create an entire investment portfolio, but without the added expense fees, additional 12b-1 fees, or other related fees.1 Most importantly, Core accounts are model portfolios developed, maintained, and managed by a registered investment firm, not a mutual fund company. This means we have a fiduciary responsibility to always do what is right for the client.

The key difference between index investing and active investing lies in the investment management approach. Index investing is a form of passive management where the goal is to match the returns of a market index by replicating its holdings. There’s minimal trading, which results in lower transaction costs and tax efficiency. Conversely, active investing involves a more hands-on approach, where fund managers make specific investment decisions with the aim of outperforming a benchmark index. This can lead to higher costs due to frequent trading and active management fees, and it requires a greater level of market insight and risk-taking.

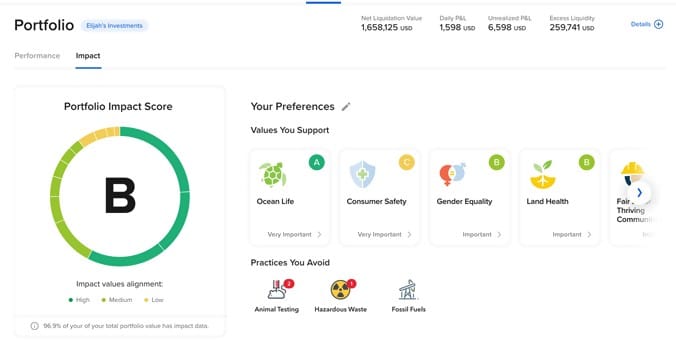

The Impact Dashboard empowers you to critically assess your portfolio, enabling you to align your investments with corporations that share your ethical outlook. Select the Impact Values and ESG (Environmental, Social, Governance) criteria—such as Racial Equality and No Animal Testing—that resonate with you. The dashboard then evaluates and rates your portfolio’s conformity with these chosen principles.

It provides insights into:

- The degree of alignment each investment has with your responsible investing objectives.

- The performance of each Impact Value you’ve identified as crucial, including the contribution of specific companies to these value ratings.

- The identification of companies implicated in practices contrary to your ethical standards.

- The proportion of your portfolio evaluated using Impact data for calculating your Portfolio Impact grade.

This “Impact Lens,” customizable to your preferences and goals, offers a transparent view of how closely the values of the companies in your portfolio match your own, with the flexibility to adjust these benchmarks as your priorities evolve.

We provide expertly managed ESG (Environmental, Social, Governance) and Sustainable Investing Accounts, catering to investors who aim to effect positive environmental and social change through their investment choices. By allocating capital into companies, organizations, and funds committed to ethical practices, we strive to produce tangible social and environmental benefits in tandem with financial gains. This investment strategy not only supports the growth of businesses dedicated to solving pressing global challenges but also offers investors the opportunity to contribute meaningfully to societal and ecological well-being. Through these investments, we channel necessary resources towards addressing critical issues, thereby fostering a sustainable future while achieving competitive financial returns for our clients.

- All portfolios are equal-weighted(unless otherwise stated).

- For the purpose of demonstration, all portfolios assume a starting balance of $10,000 U.S.

- Many Coire accounts have a minimum investment of $1,000 U.S.

- Portfolios with a launch date of fewer than 5 years are backtested.

- Trailing return and volatility are calculated as of the last full calendar quarter excluding management fees; portfolio income is rounded down to the nearest $1 unless otherwise noted; and the US stock market (S&P 500) is used as the benchmark for calculations unless otherwise noted.

- Value-at-risk metrics are based on monthly values.

- Not all stocks pay dividends, which is reflected in the TTM Yield.

- Significant effort is made to ensure that asset allocation models are in line with account summary, but not always possible.

- Market capitalization data is based on the rescaled long position of the equity holdings.

- Sector data is based on the rescaled long position of the equity holdings.

- Return attribution decomposes portfolio gains into their constituent parts and identifies the contribution to returns by each of the assets.

- Risk attribution decomposes portfolio risk into its constituent parts and identifies the contribution to overall volatility by each of the assets.

- Annualized rolling returns are based on a 36 or 60-month cycle.

Converting your retirement savings into a steady stream of income is challenging. Selecting the right mix of investments is a good place to start.

Where we add value:

- Customized Retirement Income Strategy: Offering expert, personalized guidance from the outset, aimed at enhancing your retirement income, with a focus on including bonds and preferred stocks as reliable income sources.

- Strategic Long-Term Investment Approach: Advocating for a prudent, long-term investment strategy that leverages the stability and recurring income potential of bonds and preferred stocks.

- Holistic Income-Optimization Management:

- Crafting portfolios that emphasize income generation, particularly through bonds and preferred stocks, to support your retirement needs.

- Performing regular evaluations and rebalancing to ensure the portfolio remains aligned with income targets and market conditions.

- Continuous market analysis to seize opportunities and mitigate risks associated with bonds and preferred stocks.

- Goal of Enhanced Financial Security: Dedicated to boosting your retirement income, ensuring a smoother transition to a financially secure retirement enriched by strategic investments in bonds and preferred stocks.

Related

Transforming retirement savings into a consistent and reliable income stream is a complex endeavor that requires strategic planning and astute investment choices. The crux of this challenge lies in crafting an investment portfolio that not only preserves capital but also generates sufficient income to support your retirement lifestyle, all while mitigating risk.

Initiating this process involves selecting a diversified mix of investments, including dividend-paying stocks, bonds, real estate investment trusts (REITs), and annuities, to create a balanced portfolio that aims to deliver steady income while protecting against market volatility. Equities, particularly those that pay dividends, offer growth potential and income, whereas bonds can provide regular interest payments, contributing to income stability.

Moreover, incorporating investments like annuities can guarantee income for a specified period or even for life, offering further security. Tailoring this investment blend to your risk tolerance, time horizon, and income needs is paramount, ensuring that your retirement funds are optimized to support a sustainable and comfortable retirement.

Eligibility

Tax Benefits

Who contributes

Contribution amounts

Contributions amounts are determined by the IRS. See Retirement Topics – 401(k) and Profit-Sharing Plan Contribution Limits for current information.

Withdrawals

Fees

Administrative responsibilities

Deadlines

Contributions limits for

Maximum combined contribution, including salary deferral, cannot exceed $58,000 for tax year (or $64,500 if age 50 or over); $61,000 for tax year 2022 (or $67,500 if age 50 or older)

Make profit-sharing contributions up to 20% of your self-employment income, up to a maximum of $58,000 for 2021 and $61,000 in .

Make a pre-tax salary deferral up to $19,500 for 2021 and $20,500 for (or $26,000 for 2021 and $27,000 for if age 50 or older).

Investment Options

A wide range of mutual funds, stocks, bonds, ETFs, and more.

- Life Insurance

- Whole Life

- Term Life

- Universal Life

- Disability Insurance

- Long-term Care

- Annuities

Health

Our family office services are meticulously designed to safeguard not just your financial assets but also the values you wish to pass on to future generations. Embracing an integrated planning approach, we address the core aspects of legacy management including family dynamics, wealth transition strategies, asset protection schemes, and the meticulous planning of business succession. This comprehensive methodology ensures that every facet of your legacy—from financial prosperity to the intangible heritage of your principles—is preserved and seamlessly transferred. By aligning wealth transfer strategies with your family’s values and goals, we ensure a cohesive and secure legacy that honors your vision across generations.

Cash flow is a key indicator of your business’ success. Investing wisely can help increase cash flow and set you up for growth.

Where we add value:

- Initial Guidance: Providing expert, ongoing investment advice from the very beginning, tailored to the unique needs of your business.

- Philosophy of Long-Term Investing: Belief that strategic, long-term investments are most advantageous for businesses seeking to grow their wealth.

- Comprehensive Investment Management:

- Crafting bespoke investment portfolios.

- Performing regular portfolio assessments and adjustments.

- Continuous Market Insights: Dedicated to the relentless pursuit of the latest market research and insights to inform investment decisions.

- Focus on Sustainable Growth: Our overarching commitment is to navigate your business investments toward enduring growth and prosperity.

Related

Investing for retirement is a meticulous process that necessitates a clear goal, a strategic approach, and optimal asset allocation. The cornerstone of retirement investing is the establishment of well-defined objectives, including the desired retirement age and the financial resources required to sustain a comfortable lifestyle. With these goals in place, formulating a strategy becomes the next critical step. This involves deciding on the savings rate, investment choices, and the timing of contributions to maximize compounding interest over time.

Asset allocation is pivotal in this equation, balancing growth potential with risk management. A diversified portfolio that spans across different asset classes—equities for long-term growth, fixed-income securities for stability, and perhaps alternative investments for additional diversification—adjusts as one nears retirement, gradually shifting towards more conservative investments to protect the accumulated wealth.

This holistic approach to retirement investing, grounded in disciplined planning and tailored asset allocation, is instrumental in building a robust financial foundation for the retirement years, ensuring that your retirement goals are not just aspirations but achievable realities.

Investing for retirement begins with a goal, a strategy, and the right asset allocation.

Where we add value:

- Personalized Retirement Investment Guidance: Delivering expert, ongoing advice from the start, specifically tailored to your retirement aspirations and financial circumstances.

- Long-Term Investment Strategy: Emphasizing the importance of disciplined, long-term investing as the foundation for a successful retirement savings strategy.

- Comprehensive Investment Oversight:

- Creation of a diversified investment portfolio designed for retirement savings.

- Routine performance evaluations and timely adjustments to align with evolving goals and market conditions.

- In-depth market research to inform strategic investment decisions.

- Commitment to Financial Security: Focused on guiding you to a financially secure retirement, with investments that are carefully positioned for both growth and stability over the long term.

Related

Whether you’re saving for college, retirement, or a major life event, establishing a long-term investment plan makes sense.

Where we add value: Many people want to invest but are unsure where to begin. From the first conversation, we provide professional ongoing investment advice that is highly customized to your unique situation.

- Personalized Advice: Offering professional, ongoing investment advice from the first conversation, tailored to your unique situation.

- Long-Term Focus: Our investment philosophy emphasizes the benefits of long-term investing for wealth building.

- Comprehensive Management: Handling all aspects of investing, which includes:

- Creating customized investment portfolios.

- Conducting regular portfolio reviews and rebalancing.

- Engaging in ongoing market and investment research.

Related

Tomorrow’s future starts today by considering factors beyond traditional risk and return.

Where we add value:

- Personalized Sustainable Advice: Offering specialized, ongoing investment counsel from the start, tailored to your values and financial goals.

- Sustainable Investment Philosophy: Believing in the power of sustainable, long-term investing for wealth building and positive societal impact.

- Comprehensive Sustainable Investment Management:

- Development of eco-conscious investment portfolios.

- Regular performance evaluations and portfolio rebalancing.

- Continuous exploration of emerging sustainable investment opportunities.

- Commitment to Impact: Dedicated to guiding your investments toward financial growth and making a meaningful, positive impact on society and the environment.

Related

- Stocks

- Bonds and Fixed Income

- Mutual Funds

- Exchange Traded Funds

- Options and Derivatives

- U.S. Spot Gold

- Hedge Funds

- Commodities

- Forex

- Metals

- Futures

Certificates of Deposit

Individual Retirement Accounts (IRAs) are pivotal in strategic financial planning, offering a less taxing avenue to secure one’s future. Traditional and Roth IRAs, while both serving the purpose of facilitating retirement savings, diverge in their tax treatment, providing flexibility to cater to different financial situations and goals.

Traditional IRAs offer tax-deferred growth, meaning contributions may be tax-deductible in the year they are made, but withdrawals in retirement are taxed as ordinary income. This can be particularly advantageous for individuals in higher tax brackets during their working years, expecting to be in a lower bracket upon retirement.

Roth IRAs, on the other hand, provide tax-free growth and withdrawal benefits. Contributions are made with after-tax dollars, allowing earnings to grow and be withdrawn tax-free in retirement. This feature is especially beneficial for those anticipating higher tax rates in the future or seeking tax diversification.

Choosing between a Traditional and Roth IRA depends on individual tax situations, retirement goals, and income levels, making it essential to align IRA selection with one’s broader financial strategy for maximum benefit.

In a few simple steps, you can create a core account that is diversified, tax-efficient, and easy on your wallet.

Life insurance stands as a cornerstone in the arsenal of estate planning tools for investment and wealth management clients, offering a versatile solution to protect income and secure a legacy for heirs. This financial instrument is pivotal not just in providing for beneficiaries in a tax-efficient manner but also in addressing the unique challenges of estate planning. Life insurance proceeds are generally tax-free, presenting an opportunity to deliver a substantial inheritance without the burden of income taxes, thereby preserving the value of the estate for beneficiaries.

Furthermore, life insurance offers a strategic means to balance inheritances among heirs, ensuring equitable distribution of wealth even in complex family situations. It can be particularly invaluable in providing for special-needs heirs, ensuring they receive the necessary financial support without jeopardizing eligibility for government benefits.

Beyond its role in estate planning, life insurance also contributes to the policyholder’s financial security. By securing a policy, clients can alleviate concerns about the well-being of their dependents, ensuring their financial needs are met in the policyholder’s absence. This makes life insurance not just a tool for legacy planning but a key component of a comprehensive financial strategy, enhancing both the stability and the strategic objectives of one’s financial and estate plans.

For investment and wealth management clients, addressing the potential financial strain posed by the escalating costs of long-term care is crucial. Long-term care insurance emerges as a strategic solution, designed to mitigate the economic impact that prolonged healthcare needs can have on an individual’s financial stability and the well-being of their family.

This type of insurance is specifically tailored to cover expenses associated with long-term care services, which are not typically covered by traditional health insurance or Medicare. These services may include in-home care, assisted living, nursing home care, and other forms of personal or custodial care needed over an extended period. By covering costs beyond the initial 100 days—a limit often associated with short-term care coverage—long-term care insurance provides a safeguard, ensuring that care needs are met without depleting an individual’s savings or assets.

Coverage parameters can vary, with policies stipulating caps on the duration of benefits (either in days or years) or specifying maximum benefit amounts. Given the diversity of long-term care insurance options available, selecting a policy that aligns with one’s financial strategy and anticipated care needs is essential. This foresight enables clients to protect their financial legacy while ensuring access to necessary care, thereby maintaining their quality of life and safeguarding their family’s financial future.

In the dynamic landscape of family office services, we recognize that as your personal circumstances and objectives evolve, so too will your taxation and estate planning requirements. Regularly scheduled meetings are pivotal in maintaining the alignment of your financial strategy with your changing needs. These sessions serve as opportunities to revisit the foundational insights garnered during our initial discovery meeting, ensuring that all aspects of your plan—ranging from estate structures to investment portfolios—are not only current but also optimized for the latest developments in your life. This iterative process guarantees that your financial blueprint remains responsive to your goals, securing your legacy and financial well-being through every phase of life.

At Global Advisers, we recognize the unique complexities of managing wealth. We offer a suite of services crafted to cater to the distinct needs of our discerning clientele. Our Investment Management service is the cornerstone of our offerings. We believe in creating bespoke investment strategies that are meticulously aligned with your individual risk tolerance, investment horizon, and overarching financial ambitions. Our goal is to not only preserve but also to grow your wealth in a manner that resonates with your personal vision for the future.

Understanding that your financial interests extend beyond investments, we offer comprehensive Risk Management and Insurance Planning. Our experts provide a thorough analysis and present recommendations for a variety of insurance products—including life, disability, and long-term care—to safeguard against the unexpected twists and turns of life. We are committed to fortifying your financial edifice against any storm that may arise.

Moreover, our Banking and Credit Management services provide exclusive access to specialized lending solutions, competitive mortgage services, and personalized banking products. Whether you are contemplating a significant purchase or require more intricate banking solutions, we stand ready to assist with advice that’s as astute as it is personal.

At our firm, we take pride in delivering not just wealth management, but a wealth of knowledge and a commitment to a lasting partnership. Join us, and let us navigate the intricacies of wealth management together, ensuring a legacy that stands the test of time.

Get help with transferring your assets into or out of Global Advisers, or moving your money internally between accounts

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

At the outset of our engagement, we undertake a meticulous initial review, encompassing preliminary due diligence on your balance sheet and existing estate strategy. This phase transitions into a comprehensive discovery process, where we delve into understanding your goals, concerns, and aspirations across a spectrum of critical areas, including tax planning, legacy building, wealth transfer, asset protection, trust planning, and philanthropy. Following discovery, our team conducts a thorough analysis of available planning techniques to align with your financial objectives. Lastly, we engage in a collaborative effort, working closely with your tax and legal advisors and other specialists to ensure a holistic and integrated approach to managing your wealth. This structured process ensures that every facet of your financial life is meticulously planned and executed with precision.

Health Savings Accounts(HSA) are one of the many ways you can manage health care costs.

Where we add value:

- Tailored Healthcare Financial Guidance: Providing expert, ongoing advice customized to manage healthcare expenses effectively.

- Strategic Healthcare Cost Management: Developing strategies for healthcare cost management and insurance optimization.

- Comprehensive Financial Strategy for Healthcare:

- Incorporating health savings accounts (HSAs) and suitable insurance policies.

- Investing in healthcare-specific financial instruments to cover expenses.

- Adaptive Financial Planning:

- Regular review and adjustment of your healthcare financial strategy to meet changing needs.

- In-depth research into healthcare trends and policies to inform decisions.

- Health and Financial Well-Being: Committed to formulating a strategic plan that ensures both your health and financial security are well protected.

Related

No matter what the current rate of interest is on your credit card debt, if it’s higher than zero, it’s too high.

Where we add value:

- Personalized Debt Reduction Guidance: Offering expert, ongoing advice tailored to your specific needs for paying off credit card debt.

- Strategic Repayment Plans: Focusing on strategies that prioritize high-interest debts for efficient repayment.

- Comprehensive Debt Management:

- Developing personalized debt repayment schedules tailored to your financial situation.

- Advising on budget adjustments to maximize debt repayment efforts.

- Providing insights into financial habits for lasting freedom from debt.

- Path to Financial Stability: Committed to navigating you through the debt repayment process, ensuring a strategy that leads to financial stability and growth.

Related

Tackle student loan debt with smart strategies and a sound investment and savings plan.

Where we add value:

- Tailored Student Loan Repayment Support: Delivering dedicated, ongoing guidance specifically designed for your student loan repayment journey.

- Customized Repayment Strategies: Creating personalized repayment plans that align with your financial goals and lifestyle, focusing on efficiency and debt elimination.

- In-depth Understanding of Repayment Options:

- Analyzing various repayment options, including those with favorable terms or potential forgiveness opportunities.

- Comprehensive Financial Planning:

- Providing budget management advice to facilitate loan repayment.

- Offering strategic financial planning insights to build wealth and prevent future debt.

- Achieving Financial Freedom: Committed to equipping you with the necessary knowledge and tools for financial independence, ensuring a secure foundation for your future financial well-being.

Related

Eligibility

Tax Benefits

Who contributes

Contribution amounts

Withdrawals

There are certain circumstances in which you may be eligible to withdraw funds before age 59½ without taking a 10% penalty. Contact us at 1-844-GALLEON to learn more.

Fees

Monthly service fees: $0

$0 maintenance fees

Annual services fees apply

Commissions: $0 per online listed equity trades

Other account fees, fund expenses, and brokerage commissions may apply

Fees may be a deductible business expense in the year they are paid.

Without submission to the IRS: $1,500, plus $250 for each participant in excess of two

With submission to the IRS: $3,000 to $3,750, plus applicable IRS filing fee, currently $3,000. The IRS reserves the right to change the filing fee at any time.

PBGC-covered plans: $400 for a request to remove coverage only; $800 for PBGC standard termination

Advisory fees:

Global Advisers charges an annual management fee.

Contributions limits for

Funded with employer contributions only. Must be funded annually.

Annual contribution levels are calculated based on age, compensation, and expected retirement age.

Plan contributions are adjusted each year and may be amended (for additional fees) if the desired contribution level needs to be revised.

Investment Options

Stocks, bonds, mutual funds, exchange-traded funds (ETFs), and certificates of deposit (CDs).

Our Managed Philanthropy services are an integral component of our family office offerings, designed to deliver strategic advisory solutions tailored to your charitable aspirations. Understanding that philanthropy is a reflection of your values and legacy, we work closely with you to articulate and achieve your philanthropic objectives. Our approach involves a thorough analysis of potential philanthropic avenues, strategic planning to maximize impact, and guidance on structuring charitable gifts to optimize tax advantages. Whether you aim to support immediate causes or establish a lasting philanthropic legacy, our expertise ensures that your contributions are both meaningful and aligned with your broader financial and estate planning goals, thereby amplifying the effect of your generosity.

It’s never too early to begin thinking about your legacy or to design your estate plan.

Estate Planning

Your legacy transcends money—it also encompasses your values. A plan is an important part of your ongoing financial goals. Trust and Estate Planning is an integral part of our Three-Phase financial planning process, which analyzes all areas of your financial goals. We begin by understanding your personal and financial circumstances, and by helping you identify and select your goals. After we analyze your current course of action, we suggest alternative courses, develop, present, and implement our recommendations, and follow through with ongoing monitoring and updating of your account assets.

Trust Advisory

Many people have heard of trusts but some are unfamiliar with which type makes the most sense for them. We advise on all types of trusts to make sure that your needs are met and your beneficiaries are appropriately included in your estate.

Our firm delivers a comprehensive suite of financial planning services, addressing all facets necessary to manage and enhance your wealth effectively. Our financial planning encompasses a detailed strategy for retirement, education funding, budgeting, and cash flow management. We are dedicated to constructing a plan that is not only robust but also flexible, ensuring that it adapts to your evolving financial needs and life stages.

In the realm of tax planning and optimization, our approach is methodical and proactive. We work diligently to devise strategies aimed at minimizing your tax liabilities and enhancing the tax efficiency of your investments and other financial activities. Our expertise allows us to navigate the complexities of tax law, ensuring that you retain more of your wealth to achieve your financial objectives.

With regards to estate planning, our advisory services extend to the creation and management of wills and trusts, aiming for an efficient transfer of your wealth to your chosen beneficiaries. Our goal is to ensure that your legacy is preserved and that estate taxes and costs are minimized, all in alignment with your wishes.

For retirement planning, our team provides guidance on the most effective savings and investment strategies to ensure you can enjoy a comfortable retirement. This includes counseling on various retirement accounts, such as IRAs and 401(k)s, ensuring that your retirement planning is both comprehensive and personalized to your circumstances.

At our core, we believe in a holistic and integrated approach to wealth management, ensuring that each aspect of your financial life is harmoniously interconnected to support your overall wealth objectives.

In retirement planning, adopting an integrative approach is crucial. It involves creating a strategy that not only focuses on financial elements but also incorporates lifestyle, health, and long-term objectives, ensuring a well-rounded retirement plan.

Central to this is building a diversified investment portfolio tailored to an individual’s risk capacity and tolerance. Diversification across various asset classes like equities, fixed income, and real estate mitigates volatility and aligns with the investor’s financial ability and risk preferences.

An effective retirement solution also includes:

- Efficient Withdrawal Strategies: Optimizing income while minimizing taxes.

- Healthcare Planning: Accounting for medical expenses and insurance needs.

- Estate Planning: Securing financial legacies through wills and trusts.

- Lifestyle Goals: Aligning finances with desired retirement lifestyles.

This streamlined approach not only addresses investment risks but also prepares individuals for the financial and personal aspects of retirement, supporting a secure and fulfilling retirement journey.

For those considering early retirement, a meticulously crafted plan, a robust strategy, and a forward-looking perspective are indispensable. Early retirement amplifies the need for a substantial and sustainable retirement income, given the extended duration your savings must cover. This necessitates an aggressive savings plan during your working years, coupled with strategic investments that balance growth with risk management to build a sufficient nest egg sooner.

Key to this approach is understanding your retirement income sources, including pensions, savings, investments, and any passive income streams. Early retirees must also navigate the complexities of healthcare coverage before Medicare eligibility, ensuring they have a plan to cover medical expenses.

Additionally, retiring early requires a realistic assessment of living expenses and the willingness to adjust lifestyle choices to align with financial resources. It’s critical to have contingency plans for unforeseen expenses and market volatility.

Embracing a long-term vision, where financial independence is prioritized, and informed decisions are made with the future in mind, can make early retirement not just a dream, but a feasible reality.

If you’re thinking about retiring early, make sure you have a plan, a strategy, and the right outlook on the future.

Where we add value:

- Tailored Early Retirement Guidance: Providing personalized, expert investment advice from the beginning, aligned with your early retirement objectives and financial situation.

- Long-Term Investment Focus: Advocating for focused, long-term investing as essential for accumulating the wealth needed for early retirement.

- Dedicated Investment Management:

- Developing an agile investment portfolio tailored to early retirement aspirations.

- Performing consistent portfolio performance assessments and adjustments.

- Engaging in thorough market research to stay ahead of investment trends and opportunities.

- Goal of Financial Independence: Aiming to equip you with the financial independence necessary for early retirement, with strategic investments designed for expedited growth and long-term stability.

Related

Reward your employees with investing and retirement benefits. Your brand will thank you for it.

Where we add value:

- Tailored Retirement Plan Guidance: Providing professional, ongoing investment advice from the outset, customized to the organization’s and employees’ unique needs.

- Long-Term Investment Philosophy: Belief in the critical role of strategic, long-term investing for a secure retirement.

- Comprehensive Retirement Plan Management:

- Designing diversified investment portfolios for retirement plans.

- Conducting periodic performance reviews and necessary portfolio rebalancing.

- Keeping up-to-date with the latest retirement planning trends and regulations.

- Focus on Retirement Security: Dedicated to equipping your employees with the tools and knowledge to achieve their retirement goals confidently and effectively.

Related

Taking unnecessary risks with the money you have set aside for your home can delay your financial growth. Start now with the right type of account.

Where we add value:

- Personalized Home-Buying Investment Advice: Delivering custom, ongoing guidance from the start, focused on your goal of homeownership.

- Long-Term Saving and Investment Strategy: Emphasizing the importance of disciplined, long-term strategies for accumulating a home down payment.

- Targeted Savings and Investment Process:

- Developing a specific savings plan for home buying.

- Selecting suitable investment vehicles to grow your funds effectively.

- Conducting regular portfolio reviews to keep your financial goals on track.

- Market Trends and Real Estate Opportunities Research: Staying informed about market trends and opportunities in real estate to optimize your investment strategy.

- Financial Foundation for Homeownership: Committed to providing the financial groundwork and insights necessary for successfully purchasing your home.

Related

The thought of saving for college tuition is daunting. The afterthought of not saving for it can be devastating.

Where We Add Value:

- Personalized Advice: Tailored specifically to your family’s unique educational goals and financial situation from the start.

- Strategic Long-Term Planning: Focused on maximizing educational savings and minimizing future debt through forward-thinking investment strategies.

- Comprehensive Management: Oversight of every detail in the investment process, including:

- Developing customized savings plans.

- Conducting regular portfolio assessments and adjustments.

- Continuous Research: Backed by ongoing research to ensure your college savings strategy remains optimized and responsive to changing market conditions.

- Commitment to Your Child’s Future: Ensuring your college savings efforts are as dedicated as you are to preparing for your child’s educational journey.

Related

The thought of saving for college tuition is daunting. The afterthought of not saving for it can be devastating.

Where we add value:

- Personalized College Savings Advice: Providing specialized, ongoing investment guidance tailored to your college saving goals.

- Long-Term Investment Approach: Advocating for a strategic, long-term investment strategy to accumulate funds for education.

- Dedicated College Savings Plan:

- Crafting a specific savings strategy, incorporating vehicles like 529 plans or education savings accounts.

- Regular portfolio reviews and adjustments to ensure alignment with educational funding goals and cost increases.

- Education Funding and Investment Research: Conducting continuous research to stay ahead of changes in education funding and identify optimal investment opportunities.

- Strategic Financial Planning for Education: Committed to equipping you with a comprehensive financial strategy that facilitates access to educational opportunities.

Related

Eligibility

If you are self-employed or own a business with 100 or fewer employees, you are eligible to establish a SIMPLE IRA plan, as long as it is the only retirement plan you fund. Companies maintaining another employer-sponsored retirement plan in the same year are not eligible. You must generally include all employees age 21 and over if they received at least $5,000 in compensation during any two prior years and if you reasonably expect that they will receive at least $5,000 in the current year.

Tax Benefits

Who contributes

Contribution amounts

Employer:

Mandatory match or non-elective contribution. Mandatory 3% matching contribution or 2% non-elective contribution.

Participants:

Funded by employer contributions.

Withdrawals

Fees

Administrative responsibilities

Deadlines

Matching contributions are due no later than the due date for filing your business’s income tax return including extension.

How to make contributions

Contributions limits for

Participants may contribute up to 100% of compensation with a maximum of $14,000 for ($17,000 if 50 or older)

Employer contributes either a matching or a non-elective contribution

Investment Options

A wide range of mutual funds, stocks, bonds, ETFs, and FDIC-insured CDs.

Only certain fund families have mutual funds that are eligible investments for SIMPLE IRAs with no minimum initial investment requirement.

Eligibility

Tax Benefits

Who contributes

Contribution amounts

Withdrawals

Fees

Administrative responsibilities

Deadlines

How to make contributions

Contributions limits for

Flexible annual funding requirements

Employers may contribute between 0% and 25% of compensation up to a maximum of $58,000 for and $61,000 for

Eligible employees must receive the same percentage.

Investment Options

A wide range of mutual funds, stocks, bonds, ETFs, and FDIC-insured CDs.

Get contact information and support on Employee Retirement Plans (ERP) at Global Advisers

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Our family office services offer a bespoke suite of solutions designed to alleviate the administrative complexities inherent in managing substantial wealth. By centralizing financial reporting, we streamline the oversight of your assets, ensuring clarity and cohesion across your financial landscape. Beyond mere consolidation, our expertise extends to navigating the intricate facets of your financial life, with a keen focus on stewarding your family’s wealth in alignment with your long-term objectives. This holistic approach encompasses strategic wealth management, tailored to preserve and enhance your financial legacy, while addressing the unique needs and aspirations of your family, ensuring a legacy that transcends generations.

Our investment firm’s strategy in offering wealth management services is centered on a personalized, client-focused approach. We understand that each client’s financial situation, goals, and risk tolerance are unique. Therefore, we prioritize establishing a deep understanding of our clients’ long-term objectives to tailor a bespoke wealth management plan. This strategy encompasses a thorough analysis of the market and the careful selection of investment opportunities that align with our clients’ wealth preservation and growth aspirations. We combine this with rigorous risk management practices and ongoing portfolio optimization to adapt to changing market conditions and personal circumstances. Our aim is to offer our clients a comprehensive, dynamic wealth management experience that not only meets but exceeds their expectations for financial success and security.

Sustainable Investing

Does your investment portfolio reflect your personal values?

Discover Sustainable Investing

Global Advisers’ expertise in Sustainability Investing lies far deeper than the level of understanding of which companies might represent a good investment opportunity. We strive to understand the topic at the academic level. Doing so helps us provide more depth and breadth to the level and quality of advice we provide.

Global Advisers’ expertise in Sustainability Investing lies far deeper than the level of understanding of which companies might represent a good investment opportunity. We strive to understand the topic at the academic level. Doing so helps us provide more depth and breadth to the level and quality of advice we provide.

Expense Fees[2]

Your Values

Your personal values matter. Does your personal investment account reflect them? Your investment portfolio should make a statement about your social and environmental views.

Impact Dashboard

ESG Scorecard

Learn more about the required minimum distribution (RMD) options available to you at Global Advisers

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Core Target Date retirement accounts embody a strategic investment approach tailored to align with a specific retirement year, making them an essential tool for investors aiming for a precise retirement timeline. These funds automatically adjust their asset allocation, transitioning from aggressive to more conservative investments as the target retirement date approaches. Initially, the focus is on growth-oriented assets like stocks to build wealth rapidly. Over time, the fund shifts towards bonds and other fixed-income investments to preserve capital and reduce volatility.

This dynamic adjustment mechanism is crucial for mitigating risk as one nears retirement, ensuring the investment strategy remains congruent with the investor’s decreasing risk tolerance and need for income stability. By offering a simplified investment pathway, Core Target Date funds provide investors with a streamlined, effective means of planning for retirement, making them an attractive option for those seeking a hands-off, yet customized, investment solution aligned with their retirement goals.

Our family office offerings deliver a fully integrated, comprehensive analysis of your financial landscape, encompassing your balance sheet, estate plan, and investment strategy. This collaborative endeavor involves a synergistic partnership between you, your Global Adviser Wealth Manager, and, upon your request, your legal and tax advisors. This holistic approach ensures that every facet of your financial life is meticulously aligned with your overarching objectives, facilitating a seamless integration of wealth management practices. By fostering this collaborative environment, we are able to offer nuanced, strategic insights that are tailored to your unique situation, ensuring that your wealth management strategy is not only robust and forward-thinking but also harmoniously aligned with your estate planning and tax considerations, optimizing your financial well-being and legacy.

Get answers to tax questions about dividends, tax forms, cost basis, and accessing year-end forms and more on the Global Advisers website

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Get help with security codes, downloading forms, accessing your account, or clearing your cookies and cache

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Learn more about buying and selling mutual funds, ETFs, and stocks at Global Advisers

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Protect and manage your trust accounts assets.

Availability

For estates of any size and for most kinds of trusts.

Benefits and features

Full brokerage account options make it easy to manage and protect the assets within your trust account after your passing.

Easy account consolidation

Helps prepare for the distribution of your assets after death

We provide full advisory and investment management of assets

Service and support 24/7

Types of assets

You can hold cash and securities in the trust account. Other types of assets that may be included in your trust are not included in this account and are not subject to any management fees.

Get help maintaining or updating your contact information, beneficiaries, bank accounts, and more.

Your Custodian Is…

Charles Schwab & Co., Inc.

Login to your account

follow these instructions

For support, call 1-800-435-4000

Interactive Brokers, LLC

Login to your account

follow these instructions

For support, call 1-866-694-2754, option #2

Nous ouvrons des comptes pour les individus, les entrepreneurs, les holdings familiaux, les offices de famille et les fondations. Nos services comprennent la gestion d’actifs financiers sur les marchés publics et privés, ainsi que l’accès à des options d’investissement exclusives et des solutions de financement. De plus, nous offrons des services de réseautage, ainsi qu’un soutien dans la structuration de patrimoine multi-juridictionnelle, la planification successorale transfrontalière et la gouvernance familiale.

Asset classes represent different segments of the economy and the financial markets. For example, the taxable bond asset class is comprised of debt securities such as U.S. Government bonds and Corporate bonds, whereas the international equity asset class includes stocks of publicly traded companies that are not based in the United States.

Similar to mutual funds, which are frequently offered in different share classes, Core accounts have objectives, management, and underlying investments that are identical across all classes. The primary difference is in the costs to you. Unlike mutual funds, which have different expense ratios and other fees that are unrelated to the direct management of the fund, such as 12b-1 fees, Galleon Core accounts have 0.0% expense ratios and no such fees. This simple fee structure was developed by Global Advisers with investors in mind.

Index investing offers several benefits, making it a popular choice for both novice and experienced investors. Firstly, it provides broad market exposure, reducing the risk associated with individual stocks or sectors. Secondly, it is cost-effective, as the lower turnover rates and passive management strategy result in lower fees compared to actively managed funds. Additionally, index investing offers simplicity and convenience, allowing investors to achieve a well-diversified portfolio without the need to extensively research individual securities. Lastly, over long periods, index funds have historically matched or even outperformed actively managed funds, making them an attractive option for long-term investment strategies.

- Keeping your costs under control – greater cost savings can help you build more wealth over time.

- Making investing more affordable for everyone- Galleon Core accounts combine 0.0% expense ratios with low management fees and 0.0% 12b-1 or other hidden fees.

- Expense ratios that are, on average, 100% lower than mutual funds or ETFs with comparable characteristics.

- Low turnover ratios for enhanced tax efficiency.

In addition to the normal account management fee, you may incur expenses to invest in any underlying funds, collective investment trusts, and ETFs in your portfolio (i.e., expense ratios). If you’re invested in ETFs, collective investment trusts, or mutual funds today, you’re already paying these expenses. You’ll also pay a commission to the custodian each time a security is bought or sold in your portfolio. Commissions are generally small and we do not benefit financially from custodial commissions.

Learn more information about the fee structure.

The fees are exactly the same as our other fees. Please see the fee schedule page for details.

Index investing is a passive investment strategy that aims to replicate the performance of a specific benchmark index, such as the S&P 500 or the NASDAQ Composite. It involves purchasing a diversified portfolio of stocks or bonds that mirrors the constituents of the index, allowing investors to benefit from the broad market’s returns with minimal buying and selling. This strategy is favored for its low costs, simplicity, and potential to achieve steady long-term returns, reflecting the overall market trends rather than the performance of individual securities.

While there is no minimum amount required, we suggest you start with a balance of at least $10,000.

This is an aggregate amount as based on each taxable, traditional, Roth, or rollover IRA you wish to invest.

Wealth Management services begin at $500,000. Private Wealth Management services begin at $2,000,000. We gladly work with clients with investable assets lower than these minimums under certain conditions. Contact us to learn more,

There is no minimum amount required to start investing in the Wealth Builder Program.

We can manage certain types of eligible 401(k) retirement accounts and the following types of retail Brokerage Accounts:

- Individual or joint tenants with rights of survivorship (JTWROS) taxable accounts.

- Traditional IRAs.

- Roth IRAs.

- Rollover IRAs.

- SEP IRAs

- Inherited IRAs

- Trust accounts

- Business Brokerage accounts

- SIMPLE IRAs

- Personal Defined Benefit Plans

- Company Retirement Accounts

- Custodial accounts

We recommend that you connect other custodial accounts as you plan your goals so we can incorporate them into your goal growth projections, and help you forecast your likelihood of meeting your long-term goals.

Fusce porta augue quis erat dignissim, id laoreet sapien pulvinar. Nullam blandit nisi ac nulla tempus, ultrices condimentum elit ultrices. Donec semper accumsan ligula, ut rutrum purus ultrices id. Aenean eleifend velit at nibh consectetur pretium. Vestibulum at justo quis ex venenatis aliquet. Ut porta, nunc sed venenatis maximus, lectus magna maximus dui, vel lobortis dui odio at ipsum. Curabitur nisl nisl, consequat in fermentum vitae, semper et dolor. Mauris cursus scelerisque dui et molestie. Vivamus sapien ex, aliquam sit amet libero non, auctor gravida nibh.

To invest, you’ll need to meet the following requirements:

- You have a retail brokerage account with one of our custodians. (If you’re new to Global Advisers, opening an account is simple.)

- You’re a United States resident, or you have an APO/FPO/DPO mailing address.

- You’re at least 18 years of age. (some states may have different requirements)

Advisor services are available to both U.S. and non-U.S. residents.

Diversification: Asset allocation spreads investments across various asset classes (such as stocks, bonds, and real estate) to reduce risk. Different asset classes often perform differently under the same economic conditions. By diversifying, investors can mitigate the impact of poor performance in one asset class with gains in another, reducing the overall volatility of the portfolio.

Risk Management: It allows investors to manage their risk tolerance effectively. By allocating investments according to one’s risk appetite, financial goals, and time horizon, investors can aim for optimal returns while keeping the risk at a manageable level.

Maximizing Returns: Proper asset allocation can help investors maximize returns by capitalizing on the growth potential of various asset classes. For example, equities have historically provided higher returns over the long term compared to bonds, but they come with higher volatility. Allocating assets according to personal goals and market conditions can enhance the portfolio’s growth potential.

Adaptability: Asset allocation isn’t a set-it-and-forget-it strategy. It allows for adaptability to changing market conditions and personal circumstances. As financial goals, risk tolerance, and the economic landscape evolve, reallocating assets can help investors stay on track toward their goals.

Discipline: A strategic approach to asset allocation can help investors maintain discipline during market volatility. It encourages a systematic approach to investing, such as rebalancing the portfolio to its target allocation, which can prevent making impulsive decisions based on market highs and lows.

Yes. The instruments in which you will invest are marketable securities, which almost always fluctuate in value. Even if you have invested in U.S. government bonds, the market value of the underlying bonds changes in response to various external factors, such as changes in interest rates. Stocks and ETFs also change in value, as do all other types of investments.

Sweden, Stockholm

Dreikönigstrasse 31A

Zurich 8002

Switzerland