We provide investment management and financial planning services for investors seeking professional management of their investments, money, and wealth.

We plan for their financial success through due diligence, affect risk management, strong decision-making, and an unwavering commitment to their success. We are fiduciaries who always do what is in our client’s best interest.

We provide portfolio management and financial planning services for investors seeking professional management of their investments, money, and wealth. We plan for their financial success through due diligence, strong decision-making, and an unwavering commitment to their success. We always do what is in their best interest.

Investment Management

We identify opportunities for our clients that align their preferences with current economic and market conditions. We develop and maintain investment portfolios for investors who seek long-term capital appreciation, income, and management of their assets. Explore Investment Management

Financial Planning

We develop financial plans for people who want to meet their financial needs today and plan for future goals. Each plan is uniquely tailored to your financial goals and objectives. Explore Financial Planning

Financial Planning takes into consideration all aspects of your wealth and income when preparing your plan. Whether you’re in the process of building your wealth, or if you’re near to or already in retirement, all of our plans begin with a conversation. Our goal is to understand your specific needs and make your plan more manageable. When you engage with us, we prepare a financial plan that focuses on retirement, college, estate, divorce, and business planning.

Financial Planning takes into consideration all aspects of your wealth and income when preparing your plan. Whether you’re in the process of building your wealth, or if you’re near to or already in retirement, all of our plans begin with a conversation. Our goal is to understand your specific needs and make your plan more manageable. When you engage with us, we prepare a financial plan that focuses on retirement, college, estate, divorce, and business planning.

College

A good college plan is a road map that can guide you through school to college, advise you and what to do, and track your progress throughout the process.

Learn more

Sustainable Investing

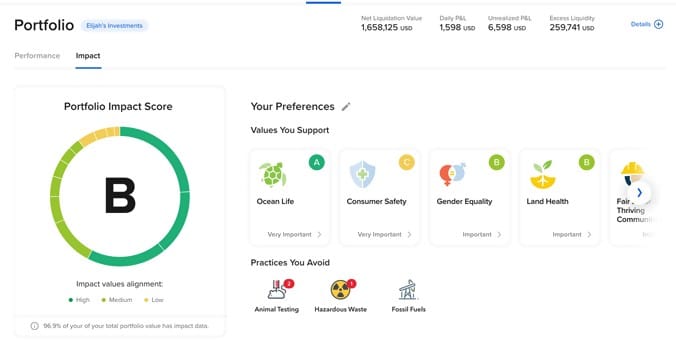

Does your investment portfolio reflect your personal values?

Discover Sustainable Investing

Global Advisers’ expertise in Sustainability Investing lies far deeper than the level of understanding of which companies might represent a good investment opportunity. We strive to understand the topic at the academic level. Doing so helps us provide more depth and breadth to the level and quality of advice we provide.

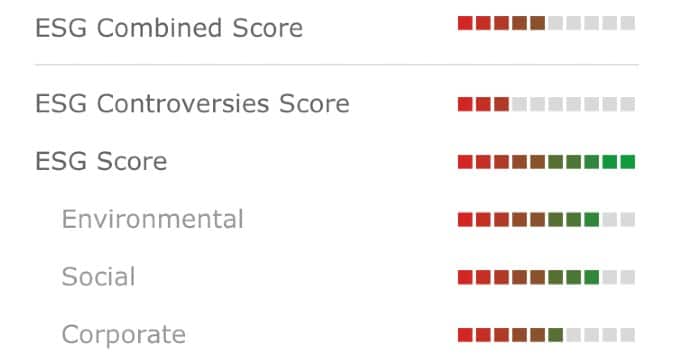

What’s Your ESG Score?

What’s Your ESG Score?

Global Advisers’ expertise in Sustainability Investing lies far deeper than the level of understanding of which companies might represent a good investment opportunity. We strive to understand the topic at the academic level. Doing so helps us provide more depth and breadth to the level and quality of advice we provide.

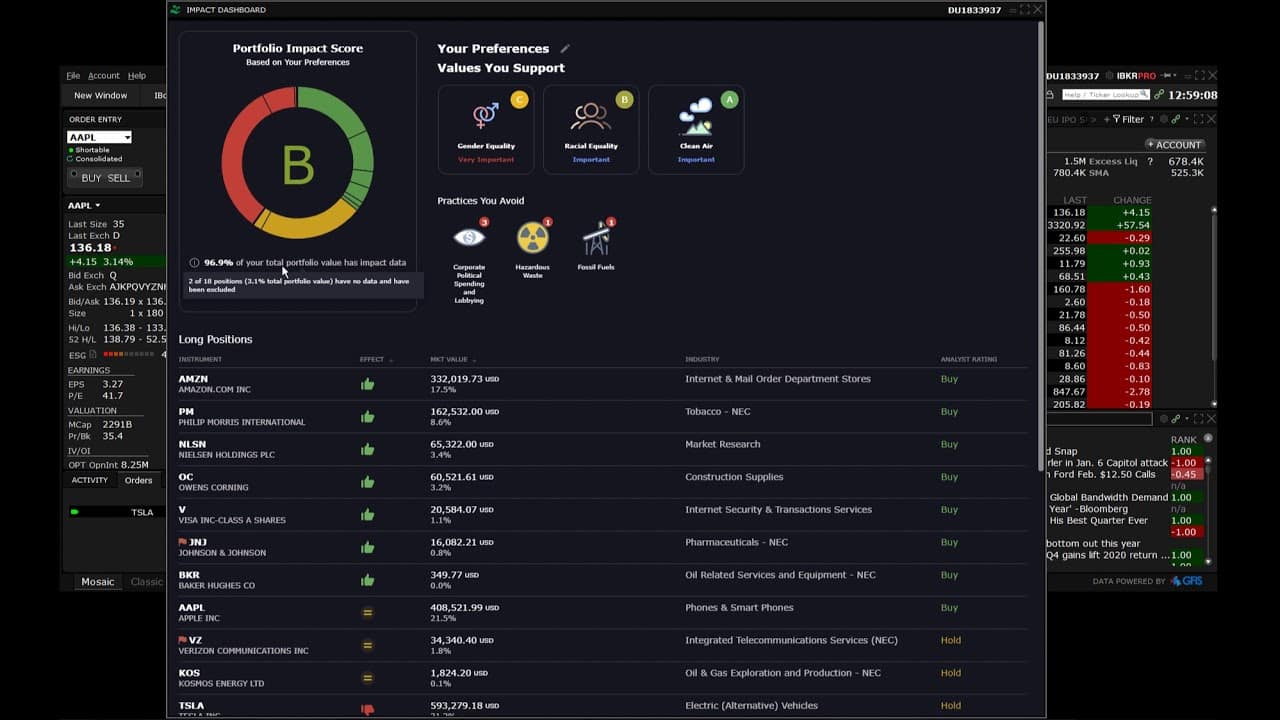

Impact App

Invest in companies with the intention of generating a measurable, beneficial impact alongside a financial return.

ESG Scorecard

We use environmental, social, and governance (ESG) scores for making investment decisions based on more than just financial factors.

Impact Dashboard

The Impact Dashboard helps you track your investments and compare them to values that you have pre-selected in your account.

Family Office Services

Helping you navigate the complex, multigenerational challenges of managing significant wealth. Explore Family Office Advisory Services Planning

1:1

Advisor-to-client ratio

Our integrated approach to planning, which includes family issues, wealth transfer, asset protection, and business succession planning helps you maintain family unity across generations by focusing on family mission, governance, conflict management, and family endowments.

Our integrated approach to planning, which includes family issues, wealth transfer, asset protection, and business succession planning helps you maintain family unity across generations by focusing on family mission, governance, conflict management, and family endowments.

Our integrated approach to planning, which includes family issues, wealth transfer, asset protection, and business succession planning helps you maintain family unity across generations by focusing on family mission, governance, conflict management, and family endowments.

The wealth management component of our family office serices is equally weighted to ensure that each phase receives the proper attention.

- 1Discovery Process

- 2Formulation of tax, trust, and estate stategy

- 3Create customized strategic asset allocation

- 4

Integrate tactical asset allocation

- 5Implement customized wealth strategy

- 6

Continuous assessment of wealth management needs

Managed Philanthropy

What if we told you that altruism is something that needs to be managed? Explore Managed Philanthropy Services

While altruism is one of the keys to a better world, it requires careful planning and intentionally designed strategies. Whether philanthropy is your vocation or your avocation, we devote a substantial amount of resources to the service of others whose goal is to affect a positive impact on the world.

Philanthropic causes vary globally. We help nonprofits refine and implement their strategies globally.

Percentage of philanthropists by region.[3]

United States

Europe

Middle East

Asia

While altruism is one of the keys to a better world, it requires careful planning and intentionally designed strategies. Whether philanthropy is your vocation or your avocation, we devote a substantial amount of resources to the service of others whose goal is to affect a positive impact on the world.

Investor Solutions

Our solutions for individuals and businesses include planning, investing, retirement, debt, cash flow, employee retention, and managed philanthropy. Explore Investor Solutions

Retirement Solutions

Everyone dreams of a comfortable, secure, and meaningful retirement. Achieving it is another matter.

Learn more

Trust and Estate Services

Designing a legacy that is consistent with your vision and values is a personal and complex process.

Learn more

Banking Solutions

Our banking solutions include high-yield checking, savings, CDs, bill pay, home loans, and debit Mastercard© to help you manage and save your money.

Learn more

Insurance Solutions

When appropriate for your specific situation, we provide access to industry-leading insurance providers who can help you establish the correct type of insurance for your needs.

Learn more

Products and Services

With a wide selection of investment, banking, lending, insurance, and alternative products and services available, we are well-positioned to help our clients meet their financial goals and objectives. Learn more about our products and services.

Investment Products

Every investor’s situation is different. That’s why we offer a wide selection of investment products to help you build a diversified portfolio and meet your investment goals.

Learn more

1. Financial Planning fees are included for Wealth Management clients who meet certain criteria. Please see our schedule for regular financial planning fees.

3. Source.https://www.statista.com/chart/3373/the-causes-philanthropists-are-most-concerned-about/