SONAR

Artificial Intelligence

Revolutionizing the Game: The Economic Impact of AI on Sports

Published on April 1, 2024

SONAR: Artificial Intelligence

Revolutionizing the Game: The Economic Impact of AI on Sports

Published on April 1, 2024

In an era where technology continuously reshapes landscapes, Artificial Intelligence (AI) has emerged as a transformative force in the sports industry. At Global Advisers, we navigate the intricacies of technological advancements, assessing their implications for economic trends and investment opportunities. The fusion of AI with sports has not only redefined athlete performance and strategy but has also reshaped fan engagement, operational efficiencies, safety protocols, and even the betting and fantasy sports domains. This analysis delves into the economic impact of AI on sports, uncovering the multifaceted opportunities it presents to investors.

Enhancing Performance and Strategy

AI’s introduction into sports has revolutionized how teams approach performance and strategy. Through data analytics and machine learning, coaches can now dissect an athlete’s performance with unprecedented precision, tailoring training regimens that optimize physical and tactical outputs.

- Economic Implications: This precision in performance analysis has bolstered the sports analytics market, with teams willing to invest heavily in AI technologies that promise a competitive edge.

- Investment Opportunities: Companies that develop AI-driven analytics platforms for performance enhancement represent lucrative investment targets. Additionally, wearable tech integrating AI for real-time data collection offers growth potential.

Transforming Fan Engagement and Experience

AI has redefined fan engagement, enabling personalized experiences that extend well beyond the game. From AI-powered chatbots providing instant customer service to algorithms curating content based on individual preferences, the sports industry is leveraging AI to deepen fan loyalty and open new revenue streams.

- Economic Implications: Enhanced fan engagement directly translates to increased revenue opportunities through ticket sales, merchandise, or digital content.

- Investment Opportunities: Ventures in AI-driven customer relationship management (CRM) solutions, personalized content platforms, and immersive technologies like VR and AR that offer unique fan experiences represent potential investment opportunities.

Optimizing Operations and Safety

Beyond performance and engagement, AI applications in operational efficiency and athlete safety present significant economic benefits. AI can streamline game day operations, from ticketing to stadium management, ensuring cost-effective and seamless experiences. In athlete safety, AI-driven tools monitor health metrics to prevent injuries, safeguarding players’ well-being and longevity.

- Economic Implications: Operational efficiencies reduce overhead costs while enhancing profitability. In safety, minimizing player injuries translates to sustained team performance and reduced healthcare expenditures.

- Investment Opportunities: Solutions that offer operational optimization, predictive maintenance for facilities, and health monitoring technologies are potential investment channels.

The Betting and Fantasy Sports Frontier

AI’s predictive capabilities have found a lucrative niche within sports betting and fantasy leagues, offering analytics that inform betting decisions and fantasy selections. This has galvanized the betting industry, introducing a level of sophistication and accuracy previously unseen.

- Economic Implications: The integration of AI in sports betting and fantasy sports is expanding the market, attracting a broader audience and increasing participation rates.

- Investment Opportunities: Platforms that provide AI-driven insights for sports betting and fantasy sports are gaining traction, presenting opportunities for investors to tap into this growing market.

AI technology’s infiltration into the sports industry marks a pivotal shift, driving economic growth, enhancing performance and fan experiences, and opening new investment avenues. For U.S. investors, the sports sector, buoyed by AI, presents a fertile ground for innovation and economic opportunity.

Navigating the Investment Landscape

The intersection of AI and sports offers a dynamic arena for investment, characterized by innovation, growth, and economic impact. For U.S. investors, engaging with this sector requires a nuanced understanding of the technology, market trends, and regulatory environments.

Strategic Considerations: Investors should carefully assess the scalability, market readiness, and competitive advantage of AI applications in sports. Partnerships with sports leagues, teams, and broadcasters can offer strategic entry points.

Ethical and Regulatory Awareness: As AI technologies advance, ethical considerations, particularly around data privacy and the use of biometric data, become increasingly important. Investors must navigate these considerations, aligning with best practices and regulatory standards.

Looking Ahead

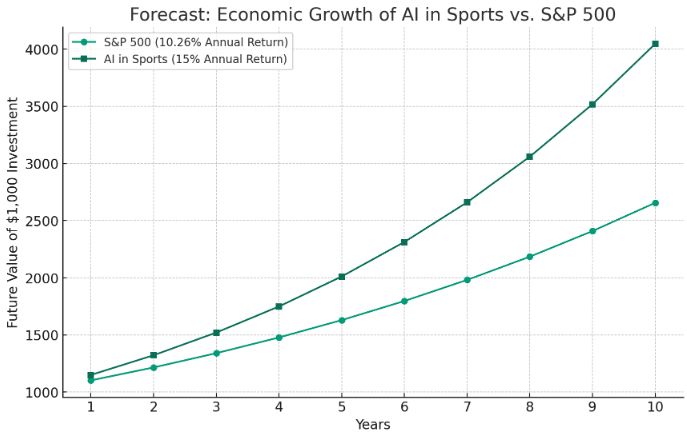

To forecast the economic growth of AI relative to the S&P 500 index, we can make some assumptions based on the historical average annual return for the S&P 500 and our hypothesized growth rate for AI within the sports sector. Given the increasing integration of AI technologies in sports and their potential to expand into other areas, it’s plausible to project a higher annual growth rate for AI investments, especially in cutting-edge sectors like sports analytics, wearable technologies, and performance optimization platforms.

Assumptions:

- S&P 500 Average Annual Return: 10.26%

- AI in Sports Sector Annual Growth Rate: We assume a more aggressive annual growth rate due to the rapid innovation and expanding adoption of AI technologies. We hypothesize a 15% annualized growth rate for AI investments within the sports sector.

- Timeframe: A 10-year horizon to observe the growth trajectory.

To illustrate the economic growth comparison, we calculate the future value of a hypothetical $1,000 investment in both the S&P 500 and an AI-focused investment within the sports sector over this 10-year period, using this formula:

Future Value=P(1+r)n

Where:

- P is the principal amount ($1,000)

- r is the annual growth rate (10.26% for S&P 500 and 15% for AI in sports)

- n is the number of years (10 years)

The chart above illustrates the forecasted economic growth of an AI investment in the sports sector compared to an investment in the S&P 500 index over a 10-year period, based on the assumptions provided. With an initial investment of $1,000, the AI sector, growing at an annual rate of 15%, shows a higher future value compared to the S&P 500, which has grown historically at a rate of 10.26% annually over a long period.

This projection underscores the potential of AI technologies in the sports sector to offer growth opportunities, particularly for investors with a high-risk profile and the ability and capacity to bear a higher level of risk who are looking for sectors with high innovation and expansion potential. It highlights the nature of AI investments in specialized fields like sports analytics and performance optimization, especially when compared to more traditional investment options. The obvious question that investors need to answer is which companies in the future will exhibit better-than-average (assuming the S&P 500 represents average) returns. At Global Advisers, we are committed to guiding our clients through these emerging landscapes. By leveraging insights into AI’s economic impact on sports, investors can harness the growth potential of this dynamic intersection.

This hypothetical analysis is provided for informational purposes only and is never meant as a recommendation to buy or sell any security or investment. Investors should always speak to an professional investment advisor before investing.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Global Advisers entity to the recipient, and Global Advisers is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Global Advisers nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.