NAVIGATE

Economy

Economic Trends Fueling Healthcare Market Opportunities

Published on March 28, 2024

NAVIGATE

Economy

NAVIGATE: Economy

Economic Trends Fueling Healthcare Market Opportunities

Published on March 28, 2024

At Global Advisers, our perspective on investment opportunities within the healthcare sector is informed by a deep understanding of economic trends and their impacts on financial markets. For investors with a growth and high-risk profile, the healthcare industry presents a compelling area for potential returns, driven by innovation, demographic shifts, and regulatory changes.

The Innovation Imperative in Healthcare

The healthcare industry is at the forefront of technological innovation, from groundbreaking biotechnologies to transformative digital health solutions. For growth-focused investors, companies leading in medical innovation offer significant potential for appreciation. Key areas include:

- Biotechnology: Advances in gene editing, personalized medicine, and novel therapies.

- Digital Health: The expansion of telehealth, wearable devices, and AI-driven diagnostic tools.

Investing in companies at the cutting edge of these innovations requires a keen eye for potential and a tolerance for the risks associated with developing technologies.

Demographic Dynamics and Healthcare Demand

An aging population in the U.S. and globally is driving demand for healthcare services, pharmaceuticals, and innovations in care delivery. This demographic trend underpins the growth potential in:

- Senior Care: Investment opportunities in facilities, services, and products catering to the elderly.

- Chronic Disease Management: Companies specializing in treatment and management solutions for chronic conditions.

For investors, demographic shifts offer a long-term growth vector, as demand for these services is likely to increase steadily.

Regulatory Environment as a Catalyst

Healthcare regulation can significantly impact market dynamics, influencing everything from drug pricing to insurance coverage. Recent and upcoming regulatory changes can create investment opportunities in:

- Compliance Solutions: Companies offering solutions to help healthcare providers navigate complex regulatory landscapes.

- Market Access: Regulatory approvals can be a major catalyst for pharmaceutical and biotech companies, impacting stock valuations.

Staying abreast of regulatory trends is crucial for investors aiming to capitalize on these catalysts.

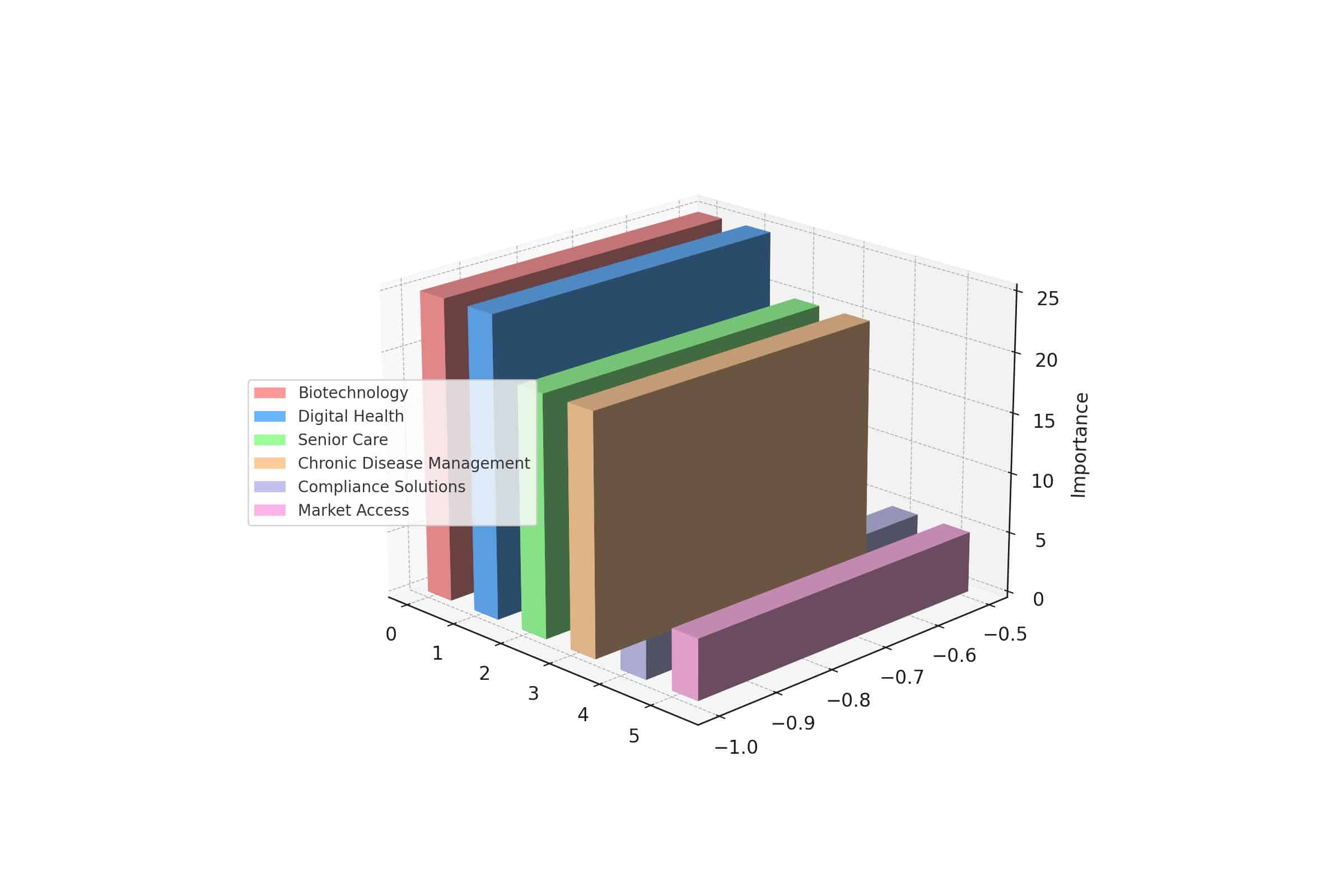

This chart represents the key investment areas within the healthcare sector. It visually conveys the emphasis on different sectors, including technological innovation, and the impact of demographic dynamics and regulatory environments on investment opportunities.

Strategic Investment Considerations

For individuals with a high-risk, growth-oriented investment profile, the healthcare sector provides a fertile ground for high-reward opportunities, albeit with corresponding risks. Strategic considerations should include:

- Diversification: Within the healthcare sector, diversifying across sub-sectors and innovation areas can help manage risk.

- Research and Due Diligence: Thorough research and due diligence are paramount in identifying companies with the potential for breakthrough success.

- Monitoring and Agility: The healthcare market is rapidly evolving, requiring investors to stay informed and be ready to adjust their portfolios in response to new information and market trends.

The confluence of innovation, demographic shifts, and regulatory developments positions the healthcare industry as a vibrant arena for growth-focused investors. At Global Advisers, we are dedicated to guiding our clients through the complexities of healthcare investing, leveraging our expertise to identify opportunities that align with their growth and risk profiles. By adopting a strategic, informed approach to investment in healthcare, growth-oriented investors can navigate the sector’s potential for significant returns.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Global Advisers entity to the recipient, and Global Advisers is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Global Advisers nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.