FINANCIAL PLANNING

Life Events

Financial Planning for a New Child: Key Strategies for Growing Families

Published on March 30, 2024

FINANCIAL PLANNING: Life Events

Financial Planning for a New Child: Key Strategies for Growing Families

Published on March 30, 2024

The joy of expecting a new child brings with it a wave of responsibilities, among which financial planning stands paramount. At Global Advisers, we recognize the significance of preparing for such a life-changing event and the complexities it introduces to financial planning. This article explores the challenges parents might face when planning for a new child and offers strategic advice for successful financial preparation.

Understanding the Financial Impact of a New Child

The arrival of a new child significantly alters a family’s financial landscape, introducing various expenses that can impact short-term budgets and long-term financial goals.

- Initial Costs: From healthcare expenses during pregnancy and delivery to the immediate needs of a newborn, initial costs can accumulate quickly.

- Ongoing Expenses: Raising a child involves continuous financial commitment, including food, clothing, healthcare, and education.

- Future Planning: Considering future costs, such as education and extracurricular activities, is essential for comprehensive financial planning.

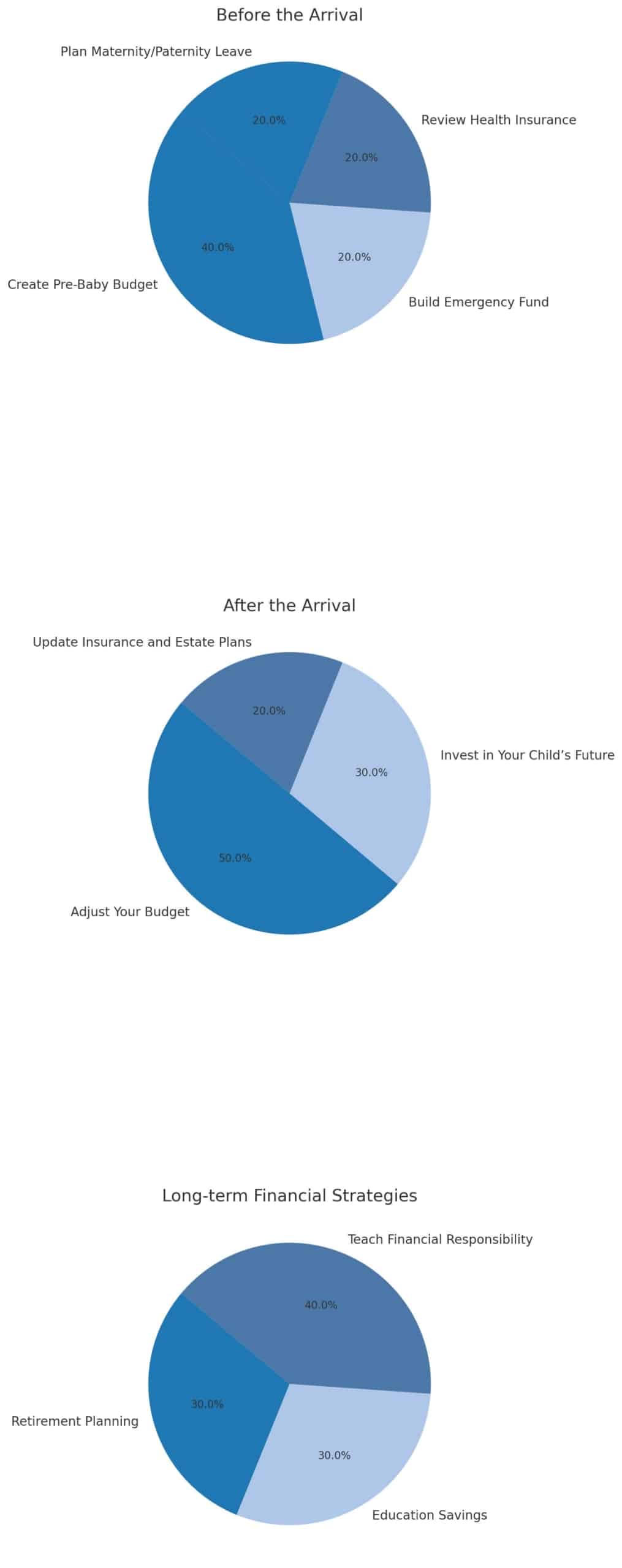

Strategic Financial Planning Before the Arrival

Proactive financial planning before the baby’s arrival can alleviate potential stress, ensuring a smoother transition for the family.

- Create a Pre-Baby Budget: Assess current income and expenses to allocate funds for baby-related costs effectively. This may involve cutting non-essential spending or increasing savings.

- Build an Emergency Fund: Aim for an emergency fund that covers at least six months of living expenses, considering the additional needs of your growing family.

- Review Health Insurance: Understand your health insurance coverage for pregnancy, delivery, and pediatric care. Consider any necessary changes or upgrades to your plan.

- Plan Maternity/Paternity Leave: Review your employer’s leave policies and plan for any unpaid leave or reduced income during this period.

Managing Finances After the Baby’s Arrival

The financial landscape shifts with the baby’s arrival, necessitating adjustments to financial planning and management.

- Adjust Your Budget: Update your budget to reflect new expenses. Track spending closely to identify areas for adjustment.

- Invest in Your Child’s Future: Consider starting a college savings plan or investment account for your child early to take advantage of compound interest.

- Update Insurance and Estate Plans: Add your child to your health insurance plan and update life insurance policies and estate documents, including wills and beneficiaries.

These charts represent a different section of the financial planning process for expecting a new child: Strategic Financial Planning Before the Arrival, Managing Finances After the Baby’s Arrival, and Long-term Financial Strategies for Growing Families. Extra weight has been placed on budgeting and planning activities, with less emphasis on updating and execution phases to demonstrate the importance of proper planning early in the process.

Long-term Financial Strategies for Growing Families

Looking beyond the immediate needs, long-term financial planning ensures that growing families can achieve their financial goals while providing for their children.

- Retirement Planning: Continue contributing to retirement savings. The addition of a family member should not derail long-term financial security.

- Education Savings: Explore education savings accounts, such as 529 plans, to prepare for future educational expenses.

- Teach Financial Responsibility: As your child grows, incorporate financial education into their upbringing, preparing them for their financial independence.

The birth of a new child is a joyous occasion that brings with it the need for thoughtful financial planning. At Global Advisers, we are committed to guiding families through this exciting yet challenging time, ensuring they are well-prepared for the financial implications. By adopting a strategic approach to financial planning, from immediate preparations to long-term considerations, families can navigate the financial aspects of welcoming a new child with confidence. Planning, adaptability, and proactive financial management lay the foundation for a secure and prosperous future for the newest addition to the family.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Global Advisers entity to the recipient, and Global Advisers is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Global Advisers nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.