SONAR

Retail Investing

Investing in the Retail Renaissance: Implications for Consumers and Investors

Published on March 30, 2024

SONAR: Retail Investing

Investing in the Retail Renaissance: Implications for Consumers and Investors

Published on March 30, 2024

In the ever-evolving landscape of the retail sector, marked by innovation and shifting consumer behaviors, discerning investors are presented with both challenges and opportunities.

At Global Advisers, we are deeply entrenched in analyzing the retail industry’s dynamics, understanding its impact on consumers, and deciphering what it spells out for investors. This comprehensive exploration delves into the current state of the retail sector, its transformational trends, and the broader implications for stakeholders.

The Transformation of the Retail Sector

The retail industry is undergoing a significant transformation, propelled by technological advancements and changing consumer expectations. E-commerce has continued to grow exponentially, reshaping the way consumers shop and interact with brands. Simultaneously, brick-and-mortar stores are not merely surviving; they are innovating, creating immersive shopping experiences that integrate digital technologies.

Sustainability and ethical consumerism have also risen to the forefront, with consumers increasingly favoring brands that demonstrate social responsibility and environmental stewardship. This shift has compelled retailers to reevaluate their supply chains, product offerings, and operational practices, aligning them with the broader values of their consumer base.

Opportunities and Challenges for Investors

For investors, the retail sector’s dynamic nature presents a landscape filled with opportunities to capitalize on emerging trends and consumer behaviors. Investing in e-commerce platforms and technology-driven retail solutions offers a pathway to growth, given the accelerated consumer adoption of online shopping. Additionally, companies at the forefront of sustainable and ethical retail practices are increasingly attractive to investors, aligning with a growing demand for socially responsible investment opportunities.

However, the retail sector is not without its challenges. The competitive landscape is fierce, especially with the dominance of major e-commerce players, making it crucial for investors to identify companies with unique value propositions and strong brand loyalty. Furthermore, the rapid pace of change in consumer preferences and technological advancements requires investors to stay agile, continuously reassessing their investment strategies to align with the sector’s latest trends.

Impact on Consumers

For consumers, the retail sector’s evolution enhances accessibility, convenience, and choice. The rise of e-commerce platforms has made an array of products available at the click of a button, often accompanied by personalized shopping experiences powered by AI and data analytics. The integration of technology in physical stores, from virtual fitting rooms to mobile payment systems, has also enriched the in-store shopping experience.

Moreover, the shift towards sustainability in retail resonates with consumers’ growing environmental consciousness, offering them options that align with their values. This not only influences purchasing decisions but also fosters a deeper connection between consumers and brands, impacting brand loyalty and consumer advocacy.

Navigating the Retail Investment Landscape

Investing in the retail sector requires a nuanced understanding of the industry’s trends, consumer behaviors, and the competitive dynamics. Our approach is anchored in comprehensive market analysis, identifying companies that demonstrate innovation, adaptability, and a strong connection with their consumer base.

We recognize the importance of diversification, balancing investments between established retail giants and emerging players that disrupt the industry with novel business models and technologies. Moreover, we emphasize the significance of sustainability and ethical practices in our investment decisions, aligning with the preferences of socially conscious consumers and investors.

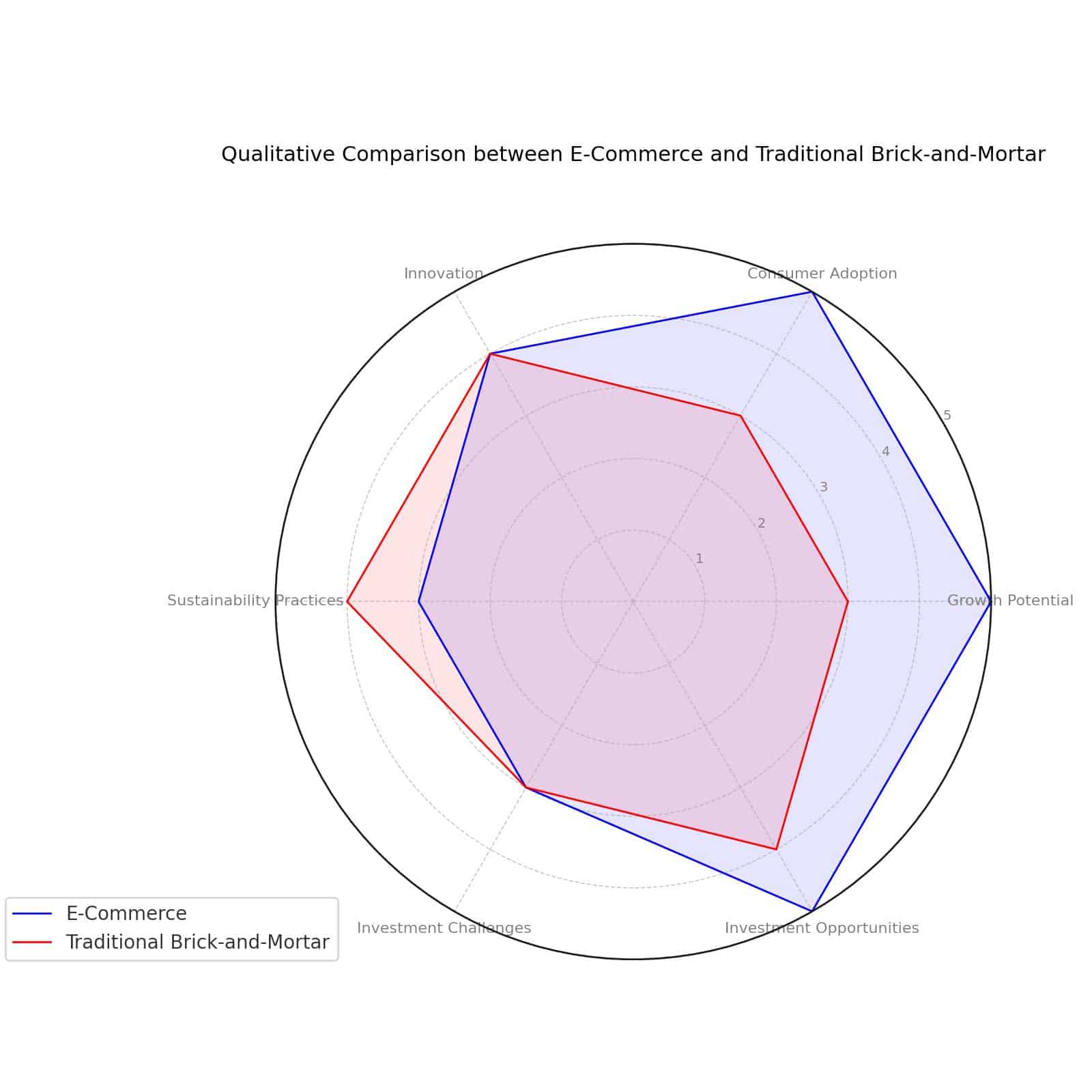

Investment Landscape: E-Commerce vs. Traditional Brick-and-Mortar Retail Stocks

| Aspect | E-Commerce | Traditional Brick-and-Mortar |

|---|---|---|

| Growth Potential | High growth due to exponential consumer adoption. | Lower growth, but opportunities in immersive shopping experiences. |

| Consumer Adoption | Rapidly increasing, driven by convenience and technology. | Steady, with a focus on creating unique, in-store experiences. |

| Innovation | AI-driven personalized shopping experiences. | Integration of digital technologies for immersive experiences. |

| Sustainability Practices | Varied; some leading in eco-friendly packaging and operations. | Increasingly focusing on ethical consumerism and sustainable practices. |

| Investment Challenges | Fierce competition, especially from major players. Requires agility due to fast-changing trends. | Must innovate to stay relevant; competition with online platforms. |

| Investment Opportunities | High, particularly in platforms and solutions driving online shopping. | Emerging opportunities in enhancing physical retail experiences and sustainability. |

As the retail sector continues to transform, it presents a dynamic arena for investors and a shifting landscape for consumers. The key to successful investment in this sector lies in understanding the underlying trends driving change, identifying companies poised for growth, and maintaining agility in investment strategies. We are committed to guiding our clients through the complexities of the retail industry, leveraging our insights to uncover opportunities that offer both financial returns and align with the evolving preferences of today’s consumers. Investing in retail is not merely about capitalizing on current trends; it’s about anticipating the future direction of consumer behavior and the retail industry at large.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Global Advisers entity to the recipient, and Global Advisers is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Global Advisers nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.