FINANCIAL PLANNING

Retirement Planning

Securing Your Future: A Guide to Achieving Retirement Planning Success

Published on March 30, 2024

FINANCIAL PLANNING: Retirement Planning

Securing Your Future: A Guide to Achieving Retirement Planning Success

Published on March 30, 2024

In today’s economic landscape, where the certainty of social security wanes and the apprehension over sufficient retirement savings escalates, effective financial planning has never been more crucial. At Global Advisers, we understand the complexities and concerns surrounding retirement planning. Our mission is to navigate you through these challenges with strategic advice and insights, ensuring a stable and secure retirement. Here’s how to approach retirement planning with confidence and clarity.

Understanding the Retirement Savings Dilemma

The reality of retirement savings today is stark. A significant portion of adults worries about the adequacy of their retirement savings, a concern exacerbated by uncertainties surrounding social security. The apprehension is not unfounded — many are off track with their retirement savings, posing a serious challenge to financial security in their later years.

- Social Security’s Uncertain Future: The reliance on social security as a primary retirement income source is increasingly precarious. It’s imperative to view social security as a supplementary income rather than the backbone of your retirement plan.

- Assessing Retirement Readiness: Acknowledging where you stand on the path to retirement readiness is the first step in rectifying any savings shortfall. A clear, honest assessment of your current savings, expected lifestyle in retirement, and potential income sources is crucial.

Laying the Groundwork for Retirement Planning

Achieving retirement planning success begins with a solid foundation. Here are some foundational strategies to enhance your retirement readiness:

- Start Early, Start Now: The best time to start saving for retirement was yesterday; the next best time is today. The power of compounding interest means that even small, regular savings can grow significantly over time.

- Maximize Retirement Account Contributions: Take full advantage of retirement accounts such as 401(k)s and IRAs. If possible, contribute the maximum allowable amount to these accounts each year to benefit from tax advantages and employer matching programs.

- Diversify Your Investment Portfolio: A diversified portfolio can help balance risk and return, especially important as you navigate different economic cycles over the years leading up to retirement.

Strategic Advice for Mid-Life Catch-Up

For those concerned they’ve fallen behind on their retirement savings, it’s crucial to understand that it’s never too late to start making significant strides. Here are strategies to bolster your retirement funds:

- Increase Savings Rates: As earnings typically peak during mid-life, channel a larger portion of your income into retirement savings. Consider lifestyle adjustments to free up more funds for saving.

- Delay Retirement: Extending your working years can have a dual benefit — additional years of savings and fewer years of retirement to fund. It also potentially increases your social security benefits.

- Reassess Risk in Your Investment Portfolio: Mid-life is a critical time to evaluate your investment risk tolerance. While growth is essential, protecting your existing savings becomes increasingly important as you near retirement.

Navigating Retirement Planning as a Late Starter

Starting late on retirement planning presents unique challenges, but strategic actions can significantly impact your financial security in retirement.

- Aggressive Saving: Prioritize retirement savings as a non-negotiable part of your budget. Aggressive saving later in life requires discipline and, often, sacrifices in current lifestyle choices.

- Smart Investing: Consider working with a financial advisor to craft an investment strategy that seeks to balance growth with risk management. Tailored advice is particularly beneficial for late starters needing to maximize their investment returns.

- Explore Alternative Income Streams: Developing alternative income streams, such as part-time work in retirement or rental income, can supplement your savings and reduce the withdrawal rate from your retirement accounts.

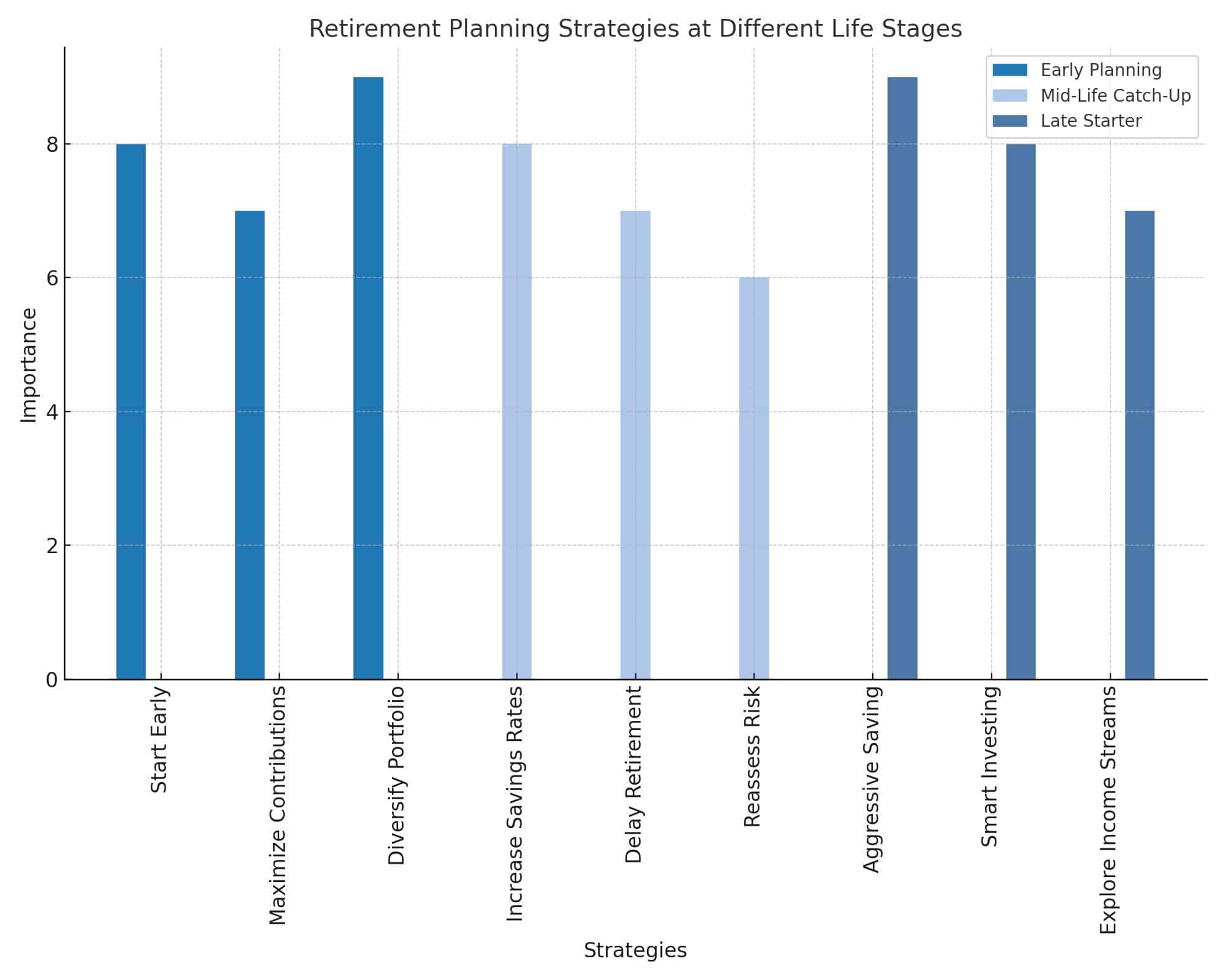

This chart represents retirement planning strategies at different life stages, visually categorizing the key strategies for Early Planning, Mid-Life Catch-Up, and Late Starters. It aims to highlight the importance of various actions individuals can take depending on their stage in life to ensure a stable and secure retirement.

The Role of Professional Financial Planning

The role of professional financial planning is pivotal in crafting a coherent and effective retirement strategy. It transcends mere investment advice, enveloping a holistic approach to managing one’s financial life with the aim of achieving specific retirement outcomes. Let’s delve deeper into the facets of professional financial planning mentioned:

Provide Customized Planning

Tailored Approach: Every individual’s financial situation, goals, and risk tolerance are unique. A professional financial planner takes these factors into account to craft a personalized retirement plan. This could involve a detailed analysis of current financial assets, future income sources, expected lifestyle, and retirement duration.

Goal Alignment: Customized planning ensures that financial strategies are aligned with personal objectives, whether it’s retiring by a certain age, maintaining a desired lifestyle, or leaving a legacy. It considers short-term and long-term goals, creating a roadmap that adapts to evolving financial and personal circumstances.

Risk Management: Personal risk tolerance is a critical component. A financial planner assesses how much risk you are comfortable taking and recommends investment strategies that match your risk profile, balancing the potential for higher returns against the possibility of loss.

Offer Investment Guidance

Investment Selection: Among the myriad of investment options available, choosing the right mix to meet retirement objectives can be daunting. Financial planners have the expertise to recommend a diversified portfolio that suits your time horizon and risk tolerance, potentially including stocks, bonds, mutual funds, and other investment vehicles.

Tax Efficiency: Strategic investment guidance also involves consideration of tax implications. Financial planners can suggest tax-efficient ways to invest and withdraw from retirement accounts, helping to minimize tax liabilities and maximize net returns.

Regular Monitoring and Rebalancing: Investment portfolios require ongoing monitoring and rebalancing to ensure they stay aligned with retirement goals. Financial planners oversee this process, making adjustments as needed in response to market fluctuations, economic changes, or shifts in personal circumstances.

Navigate Life’s Changes

Adaptive Planning: Life is unpredictable. Major events like marriage, the birth of a child, a career change, or unforeseen health issues can significantly impact retirement planning. A financial planner helps navigate these changes, adjusting your financial plan to keep your retirement goals within reach.

Continuous Support: The value of a financial planner often becomes most apparent during life’s transitions. Whether facing decisions about buying a home, paying for education, or coping with loss, a planner offers guidance and support, ensuring financial decisions are in line with overall retirement objectives.

Proactive Adjustments: Anticipating and preparing for future changes can set the foundation for a secure retirement. Financial planners proactively suggest adjustments to your plan in anticipation of life’s milestones, helping to avoid financial pitfalls and capitalize on opportunities.

In essence, professional financial planning offers a comprehensive, informed, and flexible approach to retirement planning, ensuring individuals can navigate the complexities of financial decision-making with confidence and clarity. By leveraging the expertise of a financial planner, individuals can optimize their financial resources to achieve a retirement that aligns with their vision and values.

Retirement planning is a journey fraught with challenges, uncertainties, and opportunities. At Global Advisers, we are dedicated to guiding our clients through the intricacies of building a secure retirement, offering strategic insights and solutions tailored to each individual’s needs. Whether you’re just starting out, catching up mid-way, or refining your approach as retirement nears, strategic financial planning is key to navigating the path to a successful and secure retirement. With the right strategies, discipline, and professional guidance, achieving retirement readiness is within reach, ensuring peace of mind and financial security in your golden years.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Global Advisers entity to the recipient, and Global Advisers is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Global Advisers nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.